Biden has further restricted China’s access to sophisticated chips. China placed exports controls on crucial minerals in return.

On June 27, The Wall Street Journal reported U.S. Considers New Curbs on AI Chip Exports to China

The Biden administration is considering new restrictions on exports of artificial-intelligence chips to China, as concerns rise over the power of the technology in the hands of U.S. rivals, according to people familiar with the situation.

The Commerce Department could move as soon as early next month to stop the shipments of chips made by Nvidia and other chip makers to customers in China and other countries of concern without first obtaining a license.

The move could further crimp China’s ability to build its AI capabilities after restrictions last year that cut off the most advanced AI chips made by Nvidia and Advanced Micro Devices.

Nvidia responded to that move by making a version of its AI chips for the Chinese market called the A800 that fell below performance thresholds outlined by the Commerce Department. The new restrictions being contemplated by the department would ban the sale of even A800 chips without a license, according to the people familiar with the matter.

The administration is also considering restricting leasing of cloud services to Chinese AI companies, which have used such arrangements to skirt the export bans on advanced chips, some of the people familiar with the discussions say.

China Retaliates

In response, China Retaliates Against Biden’s Chip War with export curbs on gallium and germanium,

China’s export controls on metals used in making semiconductors are “just a start”, an influential trade policy adviser said on Wednesday, as it ramps up a tech fight with the US days before US treasury secretary Janet Yellen visits Beijing.

Shares in some Chinese metals companies rallied for a second session, with investors betting that higher prices on gallium and germanium, which Beijing’s export restrictions target, could boost revenues.

Germanium is used in high-speed computer chips and plastics, and in military applications such as night-vision devices as well as satellite imagery sensors. Gallium is used in building radars and radio communication devices, satellites and LEDs.

Analysts have described Monday’s move as China’s second, and so far the biggest, countermeasure in the long-running US-China tech fight, coming after it banned some key domestic industries from purchasing from US memory chip maker Micron in May.

On Wednesday, former vice commerce minister Wei Jianguo told the China Daily newspaper that countries should brace for more should they continue to pressure China, describing the controls as a “well-thought-out heavy punch” and “just a start”.

“If restrictions targeting China’s high-technology sector continue then countermeasures will escalate,” added Wei, who served as vice commerce minister in 2003-2008 and is now the vice chairman of state-backed think-tank China Centre for International Economic Exchanges.

So far, the market reaction has been relatively tame. But it won’t be if China escalates its threat.

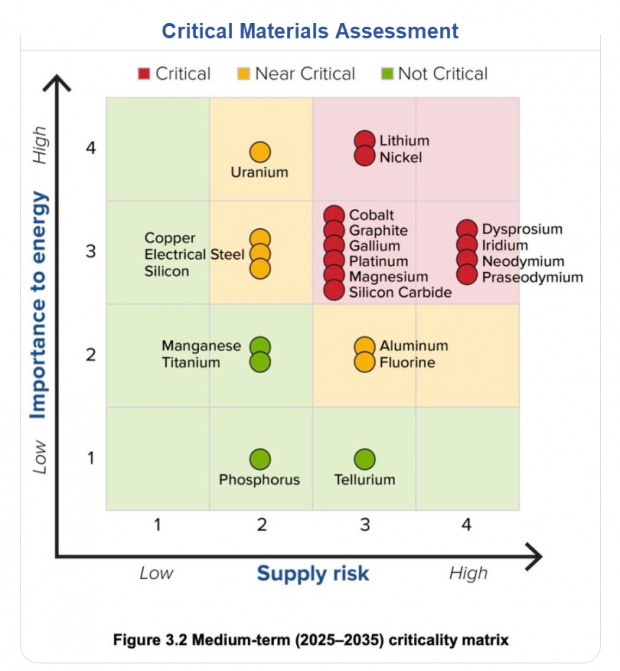

Critical Materials Assessment

Critical Materials diagram of risk vs importance by the Department of Energy.

On June 12, I commented on the Critical Materials Risk Assessment by the US Department of Energy

The Department of Energy says there are six critical materials in the short term, which include cobalt, dysprosium, gallium, natural graphite, iridium, and neodymium. The uses for these critical materials are spread across rare earth magnets, batteries, LEDs, and hydrogen electrolyzers. Germanium is used in microchips.

Critical Materials Weight Factors by Department of Energy, plus Mish Calculation.

To create the above chart, I took the short term importance and supply risk factors from the Department of Energy and multiplied them together.

Using this alternate method, the top five risks are Dysprosium, Cobalt, Gallium, Neodymium, and Lithium.

Gallium and Germanium Producers

- Germanium ores are rare and most germanium is a by-product of zinc production and from coal fly ash. China produces around 60% of the world’s germanium, according to European industry association Critical Raw Materials Alliance (CRMA), with the rest coming from Canada, Finland, Russia and the United States.

- Gallium is found in trace amounts in zinc ores and in bauxite, and gallium metal is produced when processing bauxite to make aluminum. Around 80% is produced in China, according to the CRMA. Only a few companies – one in Europe and the rest in Japan and China – can make it at the required purity, says the CRMA.

The above producer comments from Reuters.

Trump “Trade Wars Are Good and Easy to Win”

In case you forgot, please recall my March 2, 2018 post Trump Tweets “Trade Wars are Good and Easy to Win”

On January 11, 2021, Bloomberg reported How China Won Trump’s Trade War and Got Americans to Foot the Bill

I disagree with Bloomberg because no one wins trade wars. But that headline is closer to the truth than Trump’s vision.

The same applies today. Placing tariffs and sanctions on China when China produces enormous percentages of materials you need is more than a bit empty headed. Yet Biden escalated Trump’s failed policies.

The result is sure to be more inflation. Nearly everything Biden does is inflationary.

This post originated on MishTalk.Com.