The walls are closing in on your financial freedom—but not in the way most Americans believe.

While the debate rages over the future threat of Central Bank Digital Currencies (CBDCs), a far more insidious reality has already taken hold: our existing financial system already functions as a digital control grid, monitoring transactions, restricting choices, and enforcing compliance through programmable money.

For over two years, my wife and I have traveled across 22 states warning about the rapid expansion of financial surveillance. What began as research into cryptocurrency crackdowns revealed something far more alarming: the United States already operates under what amounts to a CBDC.

Provoked: How Washingt...

Best Price: $24.49

Buy New $25.70

(as of 06:57 UTC - Details)

Provoked: How Washingt...

Best Price: $24.49

Buy New $25.70

(as of 06:57 UTC - Details)

- 92% of all US dollars exist only as entries in databases.

- Your transactions are monitored by government agencies—without warrants.

- Your access to money can be revoked at any time with a keystroke.

The Federal Reserve processes over $4 trillion daily through its Oracle database system, while commercial banks impose programmable restrictions on what you can buy and how you can spend your own money. The IRS, NSA, and Treasury Department collect and analyze financial data without meaningful oversight, weaponizing money as a tool of control. This isn’t speculation—it’s documented reality.

Now, as President Trump’s Executive Order 14178 ostensibly “bans” CBDCs, his administration is quietly advancing stablecoin legislation that would hand digital currency control to the same banking cartel that owns the Federal Reserve. The STABLE Act and GENIUS Act don’t protect financial privacy—they enshrine financial surveillance into law, requiring strict KYC tracking on every transaction.

This isn’t defeating digital tyranny—it’s rebranding it.

This article cuts through the distractions to expose a sobering truth: the battle isn’t about stopping a future CBDC—it’s about recognizing the financial surveillance system that already exists. Your financial sovereignty is already under attack, and the last off-ramps are disappearing.

The time for complacency has passed. The surveillance state isn’t coming—it’s here.

Understanding the Battlefield: Key Terms and Concepts

To fully grasp how deeply financial surveillance has already penetrated our lives, we must first understand the terminology being used—and often deliberately obscured—by government officials, central bankers, and financial institutions. The following key definitions will serve as a foundation for our discussion, cutting through the technical jargon to reveal the true nature of what’s at stake:

Before diving deeper into the financial surveillance system we face today, let’s establish clear definitions for the key concepts discussed throughout this article:

Central Bank Digital Currency (CBDC)

A digital form of central bank money, issued and controlled by a nation’s monetary authority. While often portrayed as a future innovation, I argue in “Fifty Shades of Central Bank Tyranny” that the US dollar already functions as a CBDC, with over 92% existing only as digital entries in Federal Reserve and commercial bank databases.

Stablecoin

A type of cryptocurrency designed to maintain a stable value by pegging to an external asset, typically the US dollar. Major examples include:

- Tether (USDT): The largest stablecoin ($140 billion market cap), managed by Tether Limited with reserves held by Cantor Fitzgerald

- USD Coin (USDC): Second-largest stablecoin ($25 billion market cap), issued by Circle Internet Financial with backing from Goldman Sachs and BlackRock

- Bank-Issued Stablecoins: Stablecoins issued directly by major financial institutions like JPMorgan Chase (JPM Coin) or Bank of America, which function as digital dollars but remain under full regulatory control, allowing programmable restrictions and surveillance comparable to a CBDC.

Tokenization

The process of converting rights to an asset into a digital token on a blockchain or database. This applies to both currencies and other assets like real estate, stocks, or commodities. Tokenization enables:

- Digital representation of ownership

- Programmability (restrictions on how/when/where assets can be used)

- Traceability of all transactions

Regulated Liability Network (RLN)

A proposed financial infrastructure that would connect central banks, commercial banks, and tokenized assets on a unified digital platform, enabling comprehensive tracking and potential control of all financial assets.

Privacy Coins

Cryptocurrencies specifically designed to preserve transaction privacy and resist surveillance:

- Monero (XMR): Uses ring signatures, stealth addresses, and confidential transactions to conceal sender, receiver, and amount

- Zano (ZANO): Offers enhanced privacy with Confidential Layer technology that can extend privacy features to other cryptocurrencies

Programmable Money

Currency that contains embedded rules controlling how, when, where, and by whom it can be used. Examples already exist in:

- Health Savings Accounts (HSAs) that restrict purchases to approved medical expenses

- The Doconomy Mastercard that tracks and limits spending based on carbon footprint

- Electronic Benefit Transfer (EBT) cards that restrict purchases to approved food items

Know Your Customer (KYC) / Anti-Money Laundering (AML)

Regulatory frameworks require financial institutions to verify customer identities and report suspicious transactions. While ostensibly aimed at preventing crime, these regulations have expanded to create comprehensive financial surveillance with minimal oversight.

Bank Secrecy Act (BSA) / Patriot Act

US laws mandate financial surveillance, eliminate transaction privacy, and grant government agencies broad powers to monitor financial activity without warrants. These laws form the legislative foundation of the current financial control system.

STABLE Act / GENIUS Act

Proposed legislation would restrict stablecoin issuance to banks and regulated entities, requiring comprehensive KYC/AML compliance and effectively bringing stablecoins under the same surveillance framework as traditional banking.

Understanding these terms is essential for recognizing how our existing financial system already functions as a mechanism of digital control, despite the absence of an officially designated “CBDC.”

The Digital Dollar Reality: America’s Unacknowledged CBDC

The greatest sleight of hand in modern finance isn’t cryptocurrency or complex derivatives—it’s convincing Americans they don’t already live under a Central Bank Digital Currency system. Let’s dismantle this illusion by examining how our current dollar already functions as a fully operational CBDC.

The Digital Foundation of Today’s Dollar

When most Americans picture money, they imagine physical cash changing hands. Yet this mental image is profoundly outdated—92% of all US currency exists solely as digital entries in databases, with no physical form whatsoever. The Federal Reserve, our central bank, doesn’t create most new money by printing bills; it generates it by adding numbers to an Oracle database.

This process begins when the government sells Treasury securities (IOUs) to the Federal Reserve. Where does the Fed get money to buy these securities? It simply adds digits to its database—creating money from nothing. The government then pays its bills through its account at the Fed, transferring these digital dollars to vendors, employees, and benefit recipients.

The Fed’s digital infrastructure processes over $4 trillion in transactions daily, all without a single physical dollar changing hands. This isn’t some small experimental system—it’s the backbone of our entire economy.

The Banking Extension

Commercial banks extend this digital system. When you deposit money, the bank records it in their Microsoft or Oracle database. Through fractional reserve banking, they then create additional digital money—up to 9 times your deposit—to loan to others. This multiplication happens entirely in databases, with no new physical currency involved.

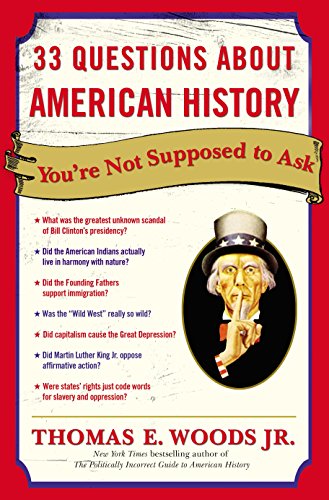

33 Questions About Ame...

Best Price: $2.91

Buy New $9.99

(as of 07:05 UTC - Details)

33 Questions About Ame...

Best Price: $2.91

Buy New $9.99

(as of 07:05 UTC - Details)

Until recently, banks were required to keep 10% of deposits as reserves at the Federal Reserve. Covid-19 legislation removed even this minimal requirement, though most banks still maintain similar levels for operational reasons. The key point remains: the dollar predominantly exists as entries in a network of databases controlled by the Fed and commercial banks.

Already Programmable, Already Tracked

Those who fear a future CBDC’s ability to program and restrict money use miss a crucial reality: our current digital dollars already have these capabilities built in.

Consider these existing examples:

- Health Savings Accounts (HSAs): These accounts restrict spending to approved medical expenses through merchant category codes (MCCs) programmed into the payment system. Try to buy non-medical items with HSA funds, and the transaction is automatically declined.

- The Doconomy Mastercard: This credit card, co-sponsored by the United Nations through its Climate Action SDG, tracks users’ carbon footprints from purchases and can shut off access when a predetermined carbon limit is reached.

- Electronic Benefit Transfer (EBT) cards: Government assistance programs already use programmable restrictions to control what recipients can purchase, automatically declining transactions for unauthorized products.

These aren’t theoretical capabilities—they’re operational today, using the exact same digital dollar infrastructure we already have.