In a functional economy with real competition and transparency, every one of these cartel-corporations would be driven out of business by their ‘too big to care’ incompetence.

We’ve all heard of Too Big to Fail, a description of the consequences of consolidating capital and power in a few corporate entities, the net result of which is monopolies and cartels becoming so large that their collapse would send the entire economy into a crisis without easy solution, as the void left cannot be filled by competitors because there are no competitors.

The Source and Signifi...

Best Price: $14.76

Buy New $22.77

(as of 10:51 UTC - Details)

The Source and Signifi...

Best Price: $14.76

Buy New $22.77

(as of 10:51 UTC - Details)

Given the risks generated by this consolidation of capital and power in cartels, the federal government and central bank had to bail out these systemically critical corporations in 2008, regardless of the cost or political precedent being established.

One would be forgiven for reckoning that the first thing the federal government would do post-meltdown was break up the Too Big to Fail entities as an unacceptably dangerous source of systemic risk. But the Central State did nothing of the sort, and the dominant firms in every sector of the economy have continued consolidating by snapping up competitors and start-ups and merging with other giants.

Everywhere we look, a few firms dominate each sector–the perfection of state-cartel-capitalism in which the core dynamics of open markets–competition and transparency–have been suffocated as obstacles to expanding profits and power. Eliminating competition and transparency is the unstoppable logic of increasing profits by any means available, for eliminating competition and transparency are the lowest-risk ways to increase profits without bothering to increase productivity or quality.

This consolidation into quasi-monopolies and cartels has moved from too big to fail to too big to care: these companies now occupy the commanding heights of the economy and so they have no incentive to improve quality and durability or seek efficiencies that can be passed on to customers. Rather, they have every incentive to reduce quality and durability to boost profits via planned obsolescence and disregard for customer service.

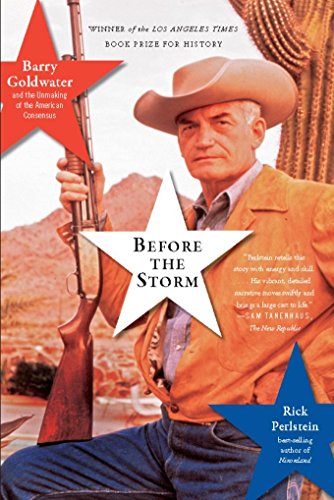

Before the Storm: Barr...

Buy New $13.99

(as of 12:42 UTC - Details)

Before the Storm: Barr...

Buy New $13.99

(as of 12:42 UTC - Details)

Cory Doctorow has performed distinguished public service in revealing the endless chicanery corporations pursue to cloak their stripmining of customers, customers with no alternative other than another member of the cartel that offers the same low quality, the same products and the same prices.

This is the sweet spot for profitability: customers have only the illusion of choice and the chicanery of too big to care is well hidden. Once the customer has no real choice, or they’re now dependent on or addicted to a product or service, then prices can be jacked up and quality can fall off a cliff to boost profits, with no blowback.