Probably the greatest error in modern economics was the abandonment of Say’s law, otherwise known as the law of the markets. In a nutshell, it demonstrated that through the division of labour, production is firmly linked to consumption, and the former is tied to the latter through the medium of money and credit.

While there are variations in production outputs of individual goods, in free markets there can never be a general glut. It was this that Keynes had to disprove in order to create a role for the state, intervening to make up for the supposed deficiencies of free markets. While reasoned analysis shows that Keynes failed to disprove Say’s law, he managed to convince the mainstream establishment that he had actually succeeded.

This article traces the history of Say’s law, from Jean-Baptiste Say’s original work on the subject to the present day. It shows how Keynes bent the truth about free markets, that an understanding of Say’s law explains why state intervention fails, and why prices will continue to rise in the imminent economic recession.

Introduction

Back in the 1930s, forward looking economists trying to justify an economic role for the state had a hurdle in classical economics to mount: the self-evident truth in what was described as Say’s law. Otherwise known as the law of the markets, Say’s law pointed out that we turn up at the factory or office to do a day’s work, so that we can afford all the things other people produce that make life tolerable, and even pleasurable.

It refers to the writings of Jean-Baptist Say, a French economist who in his A Treatise of Political Economy, originally published in 1803, described the relationship between production, consumption, and the role of the division of labour in how humans organise themselves economically-speaking. It was a remarkable achievement, defining the science of economics and the roles of money and credit in great detail, when the science was yet young.

That was over two centuries ago, before Marx proposed his rearrangement of everyone’s economy so that on behalf of workers the state acquired the means of production, and rapacious capitalists and their bourgeoise lackies would be forced to submit to the workers’ collective will.

Long before Marx and Engels, this law of the markets invited controversy. In his Principals of Political Economy published in 1820, Thomas Malthus argued it was wrong because he believed it was deficiency of demand that led to production gluts and unemployment. It was inconsistent with observed economic cycles. Malthus had gained public credence following his 1798 Essay on the Principals of Population.

Malthus’s riposte was publicly refuted by James Mill, Robert Torrens, and Say himself. David Ricardo entered into private correspondence with Malthus challenging his concept of demand deficiency. This debate continued through the first half of the nineteenth century, when economists finally accepted that a general glut of goods was implausible. Logically, therefore, a recession in the sense of inadequate demand was impossible.

Malthus was promoting a proto-Keynesian argument, and this point was taken up by Keynes in his General Theory as his justification for overturning classical economics:

“Thus, Say’s Law, that the aggregate demand price of output as a whole is equal to its aggregate supply price for all volumes of output, is equivalent to the proposition that there is no obstacle to full employment. If, however, this is not the true law relating the aggregate demand and supply functions, there is a vitally important chapter of economic theory which remains to be written and without which all discussion concerning the volume of aggregate employment are futile.” (The Principal of Effective Demand, p26)

Thus, imbalances behind production and consumption remain at the centre of economic debate today. But instead of the economic mainstream accepting that there cannot be a general glut in a free market as was accepted between 1850—1936 (the latter was the date Keynes published his General Theory), the issue has been turned upside down. The majority of today’s economists argue on the basis of their neo-Keynesian textbooks and observations of managed economies that a general glut is endemic to free markets, and that the state has a role in creating a balancing demand, for fear of unemployment.

While settling this question is always important, it is particularly so today because it is commonly agreed that most advanced economies face a recession, or at the very least will find it hard to avoid. There are subsidiary issues as well, particularly as to the causes of inflation of prices, economic cycles, and the role of money and credit.

Defining Say’s law

Jean-Baptiste Say never defined the law named after him: that was left to others. The essence of it was described in Book 1 On Production in his Principals. In Chapter 15 he wrote the following which captures the essence of it:

“Should a tradesman say, ‘I do not want other products for my woollens, I want money,’ there could be little difficulty in convincing him that his customers could not pay him in money, without having first procured it by the sale of some other commodities of their own. ‘Yonder farmer,’ he may be told, ‘will buy your woollens, if his crops be good, and will buy more or less according to their abundance or scantiness; he can buy none at all, if his crops fail altogether. Neither can you buy his wool nor his corn yourself, unless you contrive to get woollens or some other article to buy withal. You say, you only want money; I say, you want other commodities, and not money. For what, in point of fact, do you want the money? Is it not for the purchase of raw materials or stock for your trade, or victuals for your support? Wherefore, it is products that you want, and not money.’”[i]

And in a footnote to this passage, he adds:

“Even when money is obtained with a view to hoard or bury it, the ultimate object is always to employ it in a purchase of some kind. The heir of the lucky finder uses it in that way, if the miser does not; for money, as money, has no other use than to buy with.”

Say is describing the division of labour and drawing the obvious conclusion that production is inextricably linked to consumption. What is true for the farmer is true for the tradesman as well. It is as true of consumption for production as it is for final consumption. And in the footnote to it, Say makes it clear that the role of money is to facilitate the division of labour by being the bridge between production and consumption. And importantly, whether money is used immediately or hoarded or saved makes no difference.

Because Say’s law was never written down as such, Keynes was able to produce his own version without widespread contradiction: “that the aggregate demand price of output as a whole is equal to its aggregate supply price for all volumes of output, is equivalent to the proposition that there is no obstacle to full employment”. This is a deliberate misrepresentation. He followed this with a suggestion to nudge the reader into his desired direction: “If, however, this is not the true law relating the aggregate demand and supply functions…” But if the reader of his General Theory took the trouble to read Say’s Principals, he would know that Say also described the conditions that could undermine an economy at some length — including Keynes’s proposals which followed in his General Theory.

While clearly demonstrating that there is no such thing as a general overproduction relative to consumption, Say tells us that overproduction of individual products can and do exist. They result from miscalculations on the part of producers overestimating demand for their products, either through their own errors or because consumers’ desires have changed. When this happens and those employed in overestimated production lose the fruits of their labour, they also lose their ability to consume. While values for individual goods will vary (and indeed do so all the time) it will be clear that overall, the relationship between total production and total consumption is maintained.

Even malinvestments don’t upset this equilibrium. The inefficient deployment of all forms of capital are a separate issue, restricting the potential of the whole economy. And anyone who does not produce in order to consume must be subsidised by someone who does. Housewives, children, and the elderly all have to be supported by others in their family groups. Welfare ultimately comes from someone else’s production, whether through charity or taxes. And if consumption is funded through government deficit spending, it is a hidden tax on production. While government intervention in this manner causes temporary imbalances which are ironed out as markets for goods and services adjust, the balance between production and its funding of consumption is a fact of life.

Say’s law and commodities

We must also make a distinction between prices that reflect changes in production and consumption, and prices that are reflected in changes in the overall price level. The former case is covered by Say’s writings entirely.

The confusion comes when a recession, or a slump in an economy develops. Macroeconomists expect falls in prices due to a slump in demand: in other words, they anticipate a surplus of production — a Malthusian glut. There might be a negative price effect from inventory liquidation, but that is only a short-term effect and does not necessarily explain the extent of an actual decline in the general price level reflected in the value of the circulating medium. While production still funds consumption and the balance between them is maintained, it is the value of commodities which appears likely to lead to price declines, because the onset of a recession is expected to lead to a commodity surplus, before extractive industries respond by cutting their output. Oil and gas prices are particularly volatile in this respect, with much extraction volume being insensitive to changes in demand. And miners often respond initially to commodity price weakness by increasing extraction.

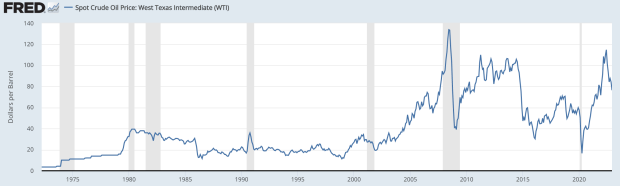

The chart below shows the price of WTI oil in US dollars and officially designated recessions. The correlation between the two is unclear, with the oil price rising early in the designated recessions in 1990 and 2007, while it fell sharply ahead of the brief recession in 2020. But it did fall later in the recessions in 1991, 2001, and in 2008. Where there is a correlation, the price effects of recessions on oil and other commodities were probably exaggerated by speculative activity in derivatives, which even drove WTI prices briefly into negative territory in April 2020.

There are also price changes emanating from changes in the currency’s valuation. WTI oil prices rose from below zero in April 2020 to a peak at $120 in only twenty-three months. But even before the Russians invaded Ukraine, while it was widely expected that they would not the price had risen to $90.

While we can posit that in an economic slump it is likely that energy and commodity input prices may decline due to inflexible output responses when measured in sound money, the situation today is that all exchange media are fiat currency and fiat-based credit. And given the sheer volatility of prices measured in fiat currencies, price changes appear to emanate from the currencies to a far greater extent than the commodities. This is clearly illustrated in our second chart, which is of oil priced in both fiat dollars and gold, the latter being the ultimate legal money in both Roman law and its modern successors for the last 1,800 years.

The value of gold itself has not been immune to influences emanating from fiat currencies and financial speculation in derivatives, imparting volatility into gold prices which would not otherwise exist.

Therefore, while we can postulate that variations in commodity prices through booms and busts can lead to a temporary appearance of commodity shortages and gluts, the evidence is that the price volatility seen in commodity values is in fiat currencies to a far greater extent than in commodity values. And therefore, when these distortions are allowed for, they are not evidence of a Malthusian glut. Furthermore, empirical evidence from the booms and slumps during the nineteenth century under gold coin standards confirms our analysis.

We can also explain depression era prices. They collapsed not due to a general glut as Keynes assumed, even allowing for the special factors affecting the agricultural industry but due to a collapse of credit thereby raising the purchasing power of gold substitutes. Banks were collapsing, destroying both asset values and bank deposits. This is what Keynes failed to understand in his desire to dismiss free markets.

State intervention and regulation

The clear purpose of Keynes’s Malthusian denial of Say’s law on the basis it didn’t explain recessions (implied in his “equivalent to the proposition that there is no obstacle to full employment”) was to lead up to his macroeconomic theory that there is a role for government in the economy in rebalancing the supply/demand relationship. By persuading himself that Malthus was correct about production gluts and unemployment being evidence of insufficient demand, he dismissed Say’s law early in his General Theory (on page 26 of 428).

Ever since, neo-Keynesians have believed in stimulating demand, partly by discouraging savings (the thrift paradox) and partly by suppressing interest rates which were seen as an unnecessary burden imposed by idle rentiers (his derogatory term for savers) on an economy. Keynes wrote, “Thus it is to a best advantage to reduce the rate of interest to that point relatively to the schedule of the marginal efficiency of capital at which there is full employment” (see his Concluding Notes). He also called for the “euthanasia of the rentier” and “…consequently, the euthanasia of the cumulative oppressive power of the capitalist to exploit the scarcity value of capital interest.” Furthermore, with respect to capital investment, he expressed the following wish:

“Thus we might aim in practice (there being nothing in this which is unattainable} at an increase in the volume of capital until it ceases to be scarce, so that the functionless investor will no longer receive a bonus, and at a scheme of direct taxation, which allows the intelligence and determination and executive skill of the financier, the entrepreneur et hoc genus omni, (who are certainly so fond of their craft that the labour could be obtained much cheaper than a present), to be harnessed to the service of the community on reasonable terms of reward.”

The direction in which Keynes’s mind was travelling was to escape from free markets entirely, into a state theory of economy. Its route ran parallel to that of Marx and the Soviets, ending at the Nirvana of a similar destination.

While very few of his fellow travellers ride with Keynes on his train of thought to the end of the line, they remain with him on the topic of economic stimulation. Famously put into action by John Law in 1716—1720 France, stimulation by currency expansion is the inflationists’ go-to way to make up for an apparent lack of demand.

Keynesian currency expansion in the context of Say’s law means that supply and demand no longer balance each other, there being additional demand whose source is not matched from the supply side. The outcome is obvious: irrespective of the general level of economic activity, too much demand for the available supply simply drives up the general price level until the extra demand is fully absorbed into the broader economy. This is tacitly admitted in modern monetary policy, which targets an inflation of prices at 2%, believing it to be either evidence of the “right level” of stimulation, or alternatively the belief that it is the prospect of rising prices which brings forward demand.

It should be clear to anyone who gives the matter serious thought that using the prospect of gently rising prices to create additional demand is addressing the wrong objective. Through Say’s law, we know that an increase in production necessarily leads to additional consumer demand. Instead of demand management, supply side reform has been shown to have economic benefits, and Say’s law explains why this is so. But at the same time, it requires fiscal discipline by the state to ensure that supply side stimulation is not funded by currency debasement. Far better for the state not to intervene at all. But now that that cat was let out of the bag long ago, statist intervention has doubled down, extending into all-encompassing regulation of economic activity.

Today, these statist objectives are commonplace. In his Principals, Say goes into their effects at some length. With respect to regulation, in Book I, Chapter 17, Section 1, he wrote the following:

“When authority throws itself in the way of this natural course of things, and says, the product you are about to create, that which yields the greatest profit, and is consequently the most in request, is by no means the most suitable to your circumstances, you must undertake some other, it evidently directs a portion of the productive energies of the nation towards an object of less desire, at the expense of another of more urgent desire.”

Before the Great Depression, the point was generally understood. And in common with others the US Government did not have a general policy of intervention or regulation. That changed, first under President Hoover, and then President Roosevelt. The precedent having been created, ever since then intervention by regulation has intensified while governments have preserved the thinnest veneer of free markets. Consequently, producers are no longer the servants of consumers, but of the state. So much so is this the case, that the level of profitability is frequently only permitted or as laid down by the authorities.

Say recounts a forerunner of the EU’s agricultural policy, when in 1794 France farmers were even executed for converting cornfields into pasture against the revolutionary government’s agricultural policy. Today, they are rewarded for rewilding their farmland. This statist desire to meddle in outputs has a long history, demonstrated by the Roman Emperor Diocletian’s edict of maximum prices in 301AD. Empirical evidence of these episodes point to their common failure to achieve statist objectives.

Modern denial of the proof of policy failure is at the behest of the statists. Surely, Keynes must have read Say’s Principals including the evidence of the dangers of intervention, translated into plain English over a century before. It is hard to imagine that he dismissed both the empirical evidence and its explanation through lack of understanding. It is perhaps an indication of human fallibility that his followers have been similarly hoodwinked.

Another favourite area of intervention is international trade and Say had much to say about this as well, concluding that:

“The sacrifice we make to foreigners in procuring the raw material is not a whit more to be regretted, than the sacrifice of advances and consumption, that must be made in every branch of production, before we can get a new product. Personal interest is, in all cases, the best judge of the extent of the sacrifice, and of the indemnity we may expect for it; and, although this guide may sometimes mislead us, it is the safest in the long run, as well as the least costly.”

This early statement of the law of comparative advantage has been ignored by governments with sometimes catastrophic consequences. The ill-thought-out Smoot-Hawley Tariff Act of 1930 not only contributed to the collapse of the US economy but combined with agricultural over-production did for the rest of the free world as well.

We can see that by giving precedence to Malthusian beliefs over the sound reasoning of J-B Say, the political class was doing no favours to their electors long before Keynes did his damage. It is damage that is not restricted to denying the obvious relationship between supply and demand but extends to the authorities’ corruption of the medium of exchange as well.

The role of money in Say’s law

In a free market, since production is turned into consumption, a medium of exchange is required between the two. It matters not whether that consumption is of end products or services; or acquiring the components for the assembly of a product or the machinery of production; or deferred consumption in the form of savings. Even if a person decides to hoard a medium of exchange, its origin is always production, and its eventual release facilitates consumption.

It follows that the determination of a medium of exchange is a matter for its users, a fact which undermines all state theories of money. In a free market, metals, particularly gold, silver, and copper have evolved as the most suitable materials for money, being durable and divisible into recognisable units. Its exchange value is also a matter solely for its users.

It is important to appreciate that a medium of exchange is not the source of wealth: that comes from successful production leading to consumption in form of the acquisition of assets, which in turn have an exchange value. Thus, the more advanced an economy based on production and consumption becomes, the greater its wealth. But the medium of exchange is not the origin of that wealth, even though its accumulation, being deferred consumption, is valued and therefore wealth itself.

This is the role of money, which as well as facilitating an exchange does so completely, leaving no legacy of risk. One can imagine that for Say’s law to be true, the medium of exchange must be sound, but its soundness is a different issue. The other form of a medium of exchange is credit, where in exchange for production its seller obtains not money, but credit. Credit includes bank notes and bank deposits, bills of exchange, and other means of transferable credit.

When gold standards existed, the value of money and money substitutes measured in goods was set between transacting individuals. The widespread adoption of metallic money and its credit substitutes allowed for an arbitrage between local values in different market centres to be made internationally. When gold buys more consumption in one jurisdiction, it will naturally gravitate from others where it buys less. And Say’s law is not confined to national trade. Trade between nations is facilitated by legal money and its credible substitutes, enhancing their wealth mutually.

The role of credit in Say’s law

In practice, the transport and recasting of gold into coin to foreign markets accustomed to different coinage was always cumbersome. This gave rise to gold substitutes — paper credit whose issuer held sufficient gold backing for it to be accepted by producers as the temporary store of their consumption. This was the basis of gold exchange standards, where bank notes, which are credit even when they are gold substitutes, were exchangeable for gold coin at the note holder’s option.

At this point in our exposition, it should be repeated that the value placed on these gold substitutes is entirely at the discretion of its users. Therefore, an issue in excess of its gold backing did not necessarily undermine the value of the substitute, so long as the expansion of the quantity of substitutes was in line with the demand for them. This rule applies to not only the notes issued by a central bank, but the credit created by commercial banks. Indeed, when we talk of a medium of exchange, or the circulating medium, in practice it is always credit, even when gold standards applied.

The attraction of credit over specie is that it allows production to develop where none existed before. There is a little-known example of the creation of bank credit which was of great commercial benefit, and that was a mechanism deployed by the Scottish banks in the early eighteenth century. Expanding bank credit for financing entrepreneurial activity became the basis of much of today’s banking activities. It is worth recounting this episode to illustrate the role of commercial bank credit.

Under Scottish law, the Bank of Scotland was founded in 1695 with unlimited powers of issue. It only issued bank notes in the following denominations: £100, £50, £10, and £5. It should be borne in mind that in today’s currency, £100 was the equivalent of £39,500 currently expressed in gold sovereigns. Clearly, the Bank of Scotland’s plan was to service and foster significant trading customers in line with banking in London, which was directed principally at dealing in discounted commercial bills. The bank did not issue £1 notes until 1704.

Its monopoly expired in 1727 and its rival, the Royal Bank of Scotland was then formed. The problem then was that with the economy being commercially undeveloped, there were not enough commercial bills available in Scotland to satisfy both banks. It was the Royal Bank which came up with a solution.

On receiving sufficient guarantees, it agreed to advance credit in limited amounts in favour of trustworthy and respectable persons. These cash credits were drawing accounts created in favour of a person who pays in no money, which he then operates as an ordinary account; except that instead of receiving interest on the balance he is charged interest. On the bank’s balance sheet, a cash credit loan was recorded as an asset, balanced by a deposit representing the amount available to be drawn down.

It was the forerunner of modern bank lending, as opposed to banking which in London at that time revolved round discounting commercial bills and lending pre-secured on collateral or deposits of specie.

The Royal Bank’s cash credits were applied in two different ways: to aid private persons in business, and to promote agriculture and the formation of commercial business of all types. Agricultural land was under-developed for lack of capital, and the system of cash credit increased agricultural output and freed enterprising individuals from the bonds of feudal society. But what particularly interests us here is loans to individuals in business.

The Royal Bank, and the Bank of Scotland subsequently entering this line of business initially limited their advances to anything between £100 and £1,000 (the equivalent in today’s sterling of about £39,500 and £395,000). No collateral was required, other than sureties from persons of standing familiar with the borrower. These “cautioners” as they were known in Scottish law, would keep a close eye on how the loans were invested, always had the right to inspect the borrower’s account at the bank, and had the authority to intervene at any time. In evidence given to a House of Commons Committee in 1826 almost a century after the Royal Bank of Scotland created them and the practice had become widespread, one witness cited the case of a modest country bank offering cash credit facilities which over twenty-one years turned over £90,000,000 at profitable credit margins and only suffered losses of £1,200.

Prior to the existence of banks offering cash credits, Scotland was a backward country whose people were more employed in cattle rustling and warring with neighbours than peaceful agriculture. Above all, there was a lack of money and only a subsistence existence. The creation of the cash credit system together with the circulation of Bank of Scotland and Royal Bank notes, which were accepted as if they were money, led to enormous progress. It even survived the Jacobite uprising of 1745. As the cash credit system became established, it was expanded for financing larger projects. The Forth and Clyde Canal was built on a cash credit of £40,000 granted by the Royal Bank. Railways, docks and harbours, roads, even public buildings were financed by cash credits.

As one example of many, Henry Menteith served twice as Lord Provost of Glasgow and subsequently the Member of Parliament for Linlithgow. He started in business as a merchant-weaver with a modest cash credit. And by 1826, Menteith was employing 4,000 men and women. The Scottish enlightenment of the eighteenth century, giving us David Hume, Adam Smith, Robert Burns and many other luminaries owes its existence to the transformation of Scotland from a backward nation by the cash credit system. In only fifty years, Scotland advanced commercially as a nation more than it had done in its entire history.

The success of cash credits and the wider adoption of their equivalent by credit unions and other organisations on a local basis in England and Wales subsequently became not only the basis of some notable fortunes but also the foundation upon which many more modest businesses thrived. There is no doubt that the evolution of bank credit from Scotland’s cash credit system has been enormously beneficial, not only to Scotland but to the wider United Kingdom. And the global adoption of English banking law transmitted the economic benefits to other civilised nations as well.

It is the destabilising cycles of bank credit expansion and contraction which is the problem, not the existence of bank credit, which is unquestionably a public benefit. Keynes failed to understand this, imputing it to a failure of free markets, and believing it to be evidence of a production glut not matched by consumption. But the facts are unarguable: that credit created production and therefore consumption until the First World War when before a silver, then a gold standard existed in the United Kingdom (admittedly with a few interruptions). Booms and slumps are created through excessive expansion of bank credit and the withdrawal of lending facilities respectively. They do not lead to Malthusian gluts.

Conclusion

Even when extra credit is introduced as the link between production and consumption, Say’s law still applies. The Scottish example quoted above offers ample proof of it being true. Even in a world based entirely on different forms of credit, its truth cannot be denied.

The dismissal of this obvious truth by Keynes and modern macroeconomists is at the root of statist economic mismanagement. Of course, there are other errors we can identify, but many of the important ones are based on the rejection of Say’s law. With the western world on the brink of an economic downturn, we can see that the Malthusian error of associating it with a production glut is misleading government economists into believing prices will collapse, justifying further inflation of central bank credit. Because this credit does not originate from the market’s demand for circulating media in accordance with Say’s law, its purchasing power will be eroded.

In an economic downturn, Say’s law explains why production and consumption will reduce in tandem, so that prices do not collapse. Analysts who call it stagflation fail to grasp this point. Indeed, one only has to refer back to every hyperinflation event to discover that they always suffer a collapse in a currency’s purchasing power at the same time as economic contraction. Keynes was malevolently wrong in dismissing it by stating that Say’s law “is equivalent to the proposition that there is no obstacle to full employment.” It is nothing of the sort.

A free market left to itself sees a continuing evolution of consumer wants and desires, with producers anticipating and adapting to them. Unfettered by state intervention, unemployment becomes necessarily low as the human resource with its various skills is demanded. Variations in credit from a cycle in bankers’ psychology is a disruptive factor, but again, left to itself corrects rapidly, and properly understood can be moderated. It is Keynes’s brand of state intervention, which is the guilty party engendering a continual crisis, eventually leading to widespread poverty. Ask any Russian who lived through the post-Soviet decade.

–

[i] The edition of Say’s Treatise on Political Economy referred to in this article is the American translation of 1821, the basis of subsequent reprints.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated.