June retail sales allegedly rose at a booming +15.6% YoY rate, thereby reminding us once again that just because you can look it up on Bloomberg doesn’t make it true. Actually, inflation-adjusted retail sales have fallen at a –13.5% annual rate since the March peak.

Then again, the March peak was an out-of-this-world aberration that underscores just how bollixed economic life has become as a result of Dr. Fauci and the Virus Patrol shutting down the great engine of the US economy last March-April, followed by a mindless compensatory bacchanalia of spending, borrowing and printing by Washington’s Infernal Inflation Machine.

One result of that madness was a cumulative 60 million layoffs and food lines for miles in many parts of the country, accompanied by the most explosive consumer spending surge ever recorded. In the equivalent of a children’s “which things don’t go together” quiz, that combo ranks in the no-brainer category.

Yet, it did happen. The March 2021 retail spending level was 42.6% above the April 2020 bottom in real terms. More importantly, it also stood 19.1% above the February 2020 level, which, of course, was recorded before the boot heels of Dr. Fauci’s minions came crashing down on the US economy.

Here’s the thing. It happens that this 19.1% pickup in monthly retail sales (excluding restaurants and bars) amounted to nearly $340 billion in constant dollar terms. In the scheme of things that’s one hell of a big number because it represents the entire increase in inflation-adjusted retail sales between February 2003 and February 2020.

That’s right. The tsunami of Washington stimmies and free stuff plus the lockdown of services venues caused a gain in retail sales for goods over the course of just 13 months that was equal to the prior 17 years of real growth.

Do we believe that kind of massive, concentrated call on retail supply chains running across the land, through the ocean ports and back to supplier factories deep in the interior of China, even to Uyghur work camps in Xinjiang Province, could drastically disrupt volumes, prices and delivery times in a world that was geared to JIT (just-in-time)?

Yes, we do, and we also wonder what was the point of Washington’s mother-of-all-stimmies?

America’s GDP plunged by 32% in Q2 2020 not because consumers ran out the means or will to spend. To the contrary, in their tens of millions they were confined to what amounted to home arrest and couldn’t spend for social congregation services by orders of the health polizei. That’s what led to the GDP contraction, not a material drop in spending for goods.

And there wasn’t any humanitarian crisis compelling this stimulus outpouring, either. The existing state unemployment system automatically provided 50% wage replacement for most workers who were actually laid off and the Federal emergency benefits for uninsured gig, contract and self-employed workers could have covered the rest for well less than $100 billion.

That is to say, in any kind of financially healthy society the in-place safety net should have been enough to prevent humanitarian hardship. But beyond that, folks who had regular job incomes or UI benefits but were not allowed to spend money on restaurants, bars, airlines, car rentals, vacation spots, gyms, beauty salons etc. could have taken a consumption sabbatical and played scrabble, cleaned the attic, joined a book club, volunteered at a charity or binged on Netflix.

They didn’t need the Fed to run the printing presses white hot to accommodate massive borrowing by Uncle Sam to fund stimmy checks, UI toppers and other free stuff so that involuntarily idled citizens could go on a (mostly on-line) retail shopping binge. That artificial spending eruption is now monkey-hammering the regular-way economy – even as it has saddled future taxpayers with trillions of unsupportable public debt.

Constant Dollar Retail Sales, 2003-2021

Lurking in this public policy madness, of course, is an assumption that the level of GDP is tantamount to a holy grail, and that the state dare not let it lag, even for a few months or quarters.

But for crying out loud, all reported GDP is not created equal. If it is 100% borrowed from future taxpayers and monetized today, it is the worst kind of GDP: Namely, Fake Prosperity that is every bit as insidious as the fake news that the Donald constantly bewailed.

Stated differently, if the real GDP level of Q4 2019 reflected the Greatest Economy Ever as per the considered judgment of both Donald Trump and Wall Street alike, and if real GDP broke-even at that level during Q2, as seems more than likely, then the total real GDP loss (2012 $) was $870 billion or just 4.5% of the $19.254 trillion rate of real GDP recorded during Q4 2019.

That is to say, if a benevolent ruler declared a one-time 5% sabbatical from work and consumption so that the people could recharge their batteries and repair their relationships with friends and family, why would this one-time delay in the upward march of GDP be so terrible? After a few years’ resumption of normalcy, this small downward squiggle in the upward ascent of both the output and spending lines on the GDP charts would hardly be noticeable.

To be sure, the Fauci dictates were not benign and the implied 4.5% loss of output, incomes and consumption were not proportionately distributed among the nation’s 130 million households. But a few hundred billion of transfer payments could have taken care of the disproportion if that is your thing.

There was absolutely no need, however, for the $6 trillion of Everything Bailouts or nearly 7X the five-quarter hole in the real GDP and the massive money-pumping spree that accompanied it. The Washington crowd simply assumed in knee-jerk fashion that because there was a state-imposed contraction of the economy’s supply-side (i.e., reduced output in the locked-down services sectors) that it needed to massively pump up the demand-side in mindless Keynesian fashion.

And mindless is what it got. During the years before the Covid peak in February 2020, inflation adjusted sales by non-store retailers had grown by about 7%-8% per annum, reflecting the maturation of the sizzling 20-year growth blitzkrieg led by Amazon and other e-commerce retailers. But rather than growing at the trend rate of 7.5% during the February 2020-March 2021 surge, inflation-adjusted non-store retailer sales actual soared by 40%, representing the pig-through-the-Python aspect of the Washington stimmy outbreak.

In constant dollars, that monthly gain was equivalent to all of the e-commerce gains during the eight years since January 2013. Obviously, a huge share of the “stuff” being delivered to the doorsteps of home bound consumers was coming thru the longest supply chain on the planet – the goods pipeline from China and its vendors.

Needless to say, that binge not only pumped the retail inventory supply chain dry, but it also led to a massive overstocking of home pantries, closets, garages, great rooms and man-caves which will generate a pretty nasty payback moment a few quarters down the road.

That’s right. Pointless boom today and bust tomorrow – all financed on Uncle Sam’s vastly overdrawn credit card.

It truly does not get any stupider than that.

Constant Dollar E-Commerce Sales, 2013-2021

By contrast, the Fauci boot heel devastated the restaurant and bar sector. In real terms, sales dropped by an incredible 54% between February 2020 and the April 2020 bottom. But the more salient thing is the speed and amplitude of the rebound: During the 14 month period between April 2020 and June 2021, inflation-adjusted sales in the restaurant and bar sector soared by 123%.

The word for 54% down followed by 123% up is economic vertigo among all parties involved – workers, managers, vendors, entrepreneurs and investors.

In constant dollar terms, the rebound was equivalent to the entire growth of this core service sector since, well, January 1992!

Literally, during the last 14 months the prostrated restaurant and bar industry has regenerated sales throughput that it had originally taken it 28 years to achieve. Is there any wonder that the sector is now festooned with help wanted signs, soaring supplier charges and delivery lead times and smartly rising wages and prices?

In a word, the one-two combination of the lockdowns and the stimmies twisted the US economy like a pretzel. There are dislocations, impairments, shortages, excesses and anomalies throughout the entire warp and woof of both the main street economy and the hideously bloated finance system alike.

Inflation-Adjusted Sales, Restaurant and Bar Sector, 1992-2021

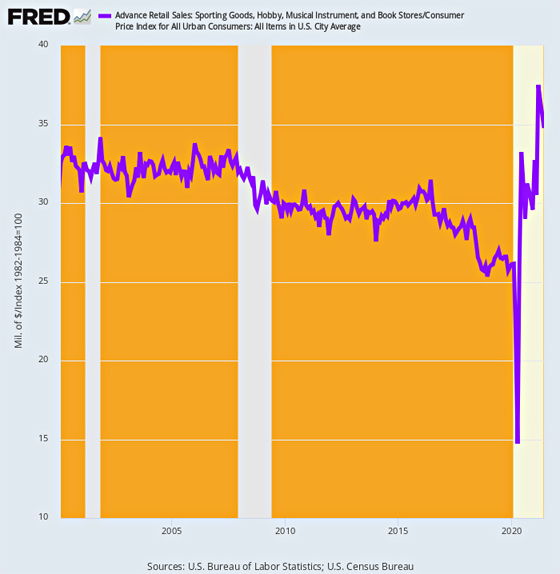

Among these distortions, of course, are the huge consumer level overstocks of goods that resulted from the Washington-assisted retail spending binge. For instance, the sporting goods, hobbies, musical instruments and book stores category had been shrinking steadily in real terms, and was down by 22% between May 2000 and the February 2020 pre-Covid peak.

But by March 2021, the inflation-adjusted sales level was 43% higher, and the chart leaves no room for doubt: Consumers stocked-up on several years worth of products in this category because Washington sent them play money and Dr. Fauci kept them out of the bars, gyms, restaurants and ball parks.

Needless to say, the payback has already started. June’s constant dollar sales were already 7.5% below the March 2021 peak, and the revert to the pre-Covid trend line is just getting its sea-legs.

Inflation-Adjusted Sales of Sporting Goods, Hobby, Musical Instrument, and Book Stores, 2000-2021

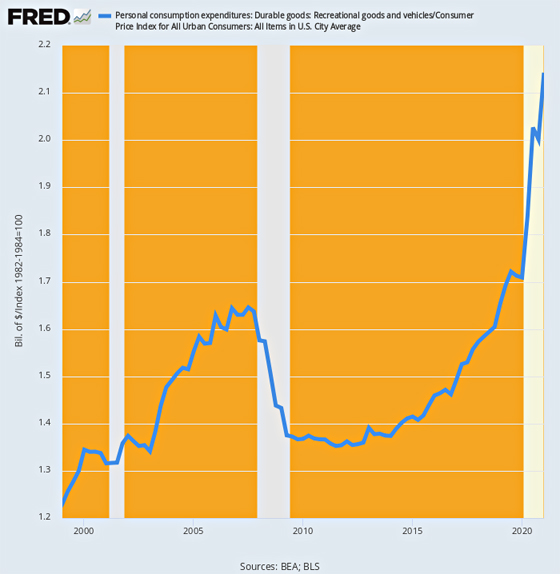

Likewise, sales of recreational vehicles and motor homes exploded during the masks-up-and-collect-your-stimmies interregnum ordered by Washington. Consumption spending in this category never missed a beat, rising by 26% between Q4 2019 and Q1 2021.

Again, that five-quarter gain was equivalent to the entire increase in inflation-adjusted spending in this category since Q2 1999. Consequently, used and new RV prices are soaring today, but we’ll take the unders a few quarters out. Literally, a decades’ worth of normal spending gains have been pulled forward into the last 15 months.

Inflation-Adjusted Spending, Recreational Goods and Vehicles, 1999-2021

The truth is, Washington has no clue about how to macro-manage a calm ordinary-course economy in the context of today’s globally-integrated commerce and finance. But after having twisted the American economy into a turbulent pretzel during the past 15 months the odds that Washington will generate plenary and unexpected disruptions and disorder in the period just ahead are extraordinarily high.

As BofA’s Michael Hartnett noted recently, Washington has descended into flat-out borrow-spend-print insanity, without the slightest clue as how the twisted pretzel it has confected will respond.

“the Fed is spending $336 million every 60 minutes buying bonds, while the US federal government is spending $875 million every hour this year,” a staggering amount made possible only by the recent merger between the Fed and Treasury which ushered in not only helicopter money but its socialist offshoot, MMT. It’s also what so many monetarists argue is behind the recent surge in inflation, because Milton Friedman said best, “inflation is always and everywhere a monetary phenomenon.”

Nor is this merely a short-run gong show. Washington’s Infernal Inflation Machine has been badly impairing and distorting America’s engine of capitalist prosperity for the better part of three decades, but especially since the Fed went off the deep-end with money-printing during the great financial crisis.

The chart below shows the reported growth of real GDP versus domestic production of final products and non-industrial supplies. The latter is the heart of economic value added, and the idea that any economy can borrow its way to prosperity by having its citizens do each others’ laundry at home while importing the lion’s share of goods from abroad is just plain economic crankery.

Yet that’s essentially what has been happening in the way the Earnest Hemingway famously described the route to bankruptcy: slowly at first, and then of a sudden.

Thus, between 1972 and 2007, real GDP grew by $10.5 trillion or by 3.12% annually, while real domestic production of final goods and supplies rose by $2.5 trillion or 2.46% per annum. That might well have been described as a tolerable arrangement, but one not sustainable in the very long run.

Since Q4 2007, however, the data has evolved in such a manner as to remove all doubt. Real GDP during the 53 quarters through Q1 2021 expanded by $3.3 trillion or at a record low of just 1.45% per annum. And one big part of the cause for this drastic slowdown from historic 3.0%+ rates of real GDP growth was that real domestic production of final goods and supplies actually declined by $327 billion during that 13 year period, from $4.32 trillion to $3.99 trillion.

That’s right. After endless boasting and ballyhoo from the Eccles Building about it’s brilliant management of the post-crisis recovery, the truth is the inflation-adjusted production economy in the US is still actually smaller than it was in Q4 2007.

At the end of the day, Washington’s Infernal Inflation Machine has been deeply impairing the main street economy with runaway debt and financial asset inflation for decades. Then, during the Covid-Lockdown shock, it turned it into an economic and financial pretzel.

Production of Real Finished Goods and Supplies versus Real GDP, 1972-2021

Needless to say, this will not end well, and one of the reasons is that production of goods and materials has now fallen to just 21% of GDP compared to 35% five decades ago. In Part 2 we will address the myth that doing each other’s laundry is a viable roadmap to prosperity.

Real Goods And Supplies As % Of Real GDP, 1972-2021

PEAK TRUMP, IMPENDING CRISES, ESSENTIAL INFO & ACTION

Reprinted with permission from David Stockman’s Contra Corner.