Imagine a casino full of slot machines that all guarantee a constant high return. All you need to do is to put in a bit of money and you will get an incredible income stream for life.

Well, this is exactly what the stock market is, namely a remarkable slot machine with a continuous flow of guaranteed payouts. No skill is required, and relatively little money. And the wonderful thing is that you don’t even need to be lucky since the machine just continues to spew out money without the need for either a strategy or dexterity.

ALFRED – A STOCK MARKET WINNER WITH ZERO TALENT

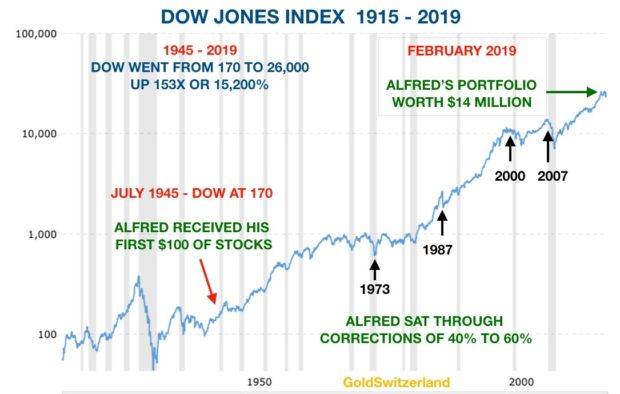

Why should we time the stock market when it works so well for us. Let’s take the example of a stock market investor called Alfred who was born at the end of WWII and is now 74 years old. At his birth, his grandparents gave him $100 of stocks in the Dow Jones index and between the parents and grandparents $10 was saved monthly to buy stocks for Alfred. All the money went into Dow stocks and dividends were reinvested. By the time Alfred was 24, in 1969, he started working and earned a good salary since he had an excellent education. So he could save $250 per month. Ten years later Alfred had done well in his career and could save $2,000 per month until his retirement at 65 in 2010. His investment account had by that time grown to $6.7 million. He continued to be fully invested in the market from 2010 and saved $1,000 per month of his pension until today. By February 2019, Alfred has amassed a stock portfolio worth $14 million. Alfred had excellent tax advisors so he could avoid capital gains taxes or other taxes on his investments.

How an Economy Grows a...

Buy New $10.99

(as of 12:20 UTC - Details)

How an Economy Grows a...

Buy New $10.99

(as of 12:20 UTC - Details)

The total savings of Alfred’s parents, grandparents and his own amounted to around $1 million over a 74 year period which all went into stocks. Most of it was Alfred’s own savings from his work. The stock market looked after Alfred and his savings very well so that he managed to grow the money invested 14x from $1 million to $14 million. Alfred naturally considered himself to be a very talented stock investor but his luck was that no talent was required nor market timing since Alfred only bought the Dow Jones Index.

ALFRED IS A PERMABULL – IN SPITE OF MANY 40-60% DRAWDOWNS

So far so good. Alfred has done extremely well in the stock market in spite of some hair raising market falls. During this period Alfred had to suffer some major paper losses like in 1973-4 when the market lost 40% or in 1987 when the market had a similar fall of 40%. But Alfred was never worried since his experience was that stocks always go up. Alfred is a Permabull.

Alfred is now 74 and he has, thanks to his Grandparents’ and Parents’ wisdom, which was passed onto him, amassed a considerable fortune of $14 million. Alfred knows that he is not going to spend all that money so it will pass over to his children and grandchildren.

ALFRED OUTPERFORMED 99% OF ALL INVESTORS

During his 74 year life, Alfred has probably outperformed 99% of all stock market investors. And he has had no mean competition. Especially since the late 1980s, the investment industry had become extremely sophisticated, using high powered computers, rocket scientists, high frequency trading and very complex financial instruments or derivatives. The asset management industry has built up a massive cost structure consisting of grossly overpaid staff with very expensive systems and infrastructure costs. But even with all these costly state of the art systems, the industry has been underperforming Alfred and any other index investors.

PROFESSIONAL INVESTORS FIRST LINE THEIR OWN POCKETS

So who is paying for these massive costs and especially the bonuses in the hundreds of thousands, millions or even tens of millions that many of the people in the industry are earning? The costs obviously reduce the returns that the investors earn and in the end these costs are paid by ordinary people such as fund holders, pension fund members, or other institutional investors.

These costs reduce the return over time dramatically and virtually no fund manager will have achieved the returns that Alfred did. Thus, there is a massive industry that has been created which only lines its own pockets at the expense of ordinary people.If we just take the example of the 2007-9 crash, we know that most investment banks would have gone bankrupt without a massive rescue package by central banks to the tune of $25 trillion including loans, credit lines and guarantees. In spite of this, staff at these banks got the same substantial bonuses in 2008 as in 2007, from banks that only survived due to government assistance. Thus, bank profits line the pockets of the bankers whilst losses are picked up by the state which means ordinary people.

Coming back to Alfred, he has had such a good run so should he now be concerned that he and his family will lose it all. Has he just been lucky or is he a very shrewd investor. He realises that it is not really his clever investment skills that have got him where he is today. He has never selected a single stock in his life since he has just invested in the index. Nor has he ever analysed a company or the state of the market. As Alfred says: “After all, investing is so simple, you just buy and hold and the market will do all the work for you.” And who can argue with Alfred. He started with $100 and now has $14 million.