Unprecedented Global Risk – No One Cares

September 16, 2017

“Risk involves the chance an investment’s actual return will differ from the expected return. Risk includes the possibility of losing some or all of the original investment.” (Investopedia)

So there we have it. Risk means that you can lose part or all of the investment. Normally valuations take risk into account. But is the world really valuing the following risks accurately:

A VERY RISKY WORLD

Wars

- North Korea – South Korea – USA – Japan – China – Russia incl. nuclear war

- Ukraine – USA – Russia

- Syria – Israel – USA – ISIS – Al-Qaeda – Saudi Arabia, Yemen – Iran, Iraq etc.

- China – India – Pakistan – Afghanistan – USA

- Plus many more

Buy Silver at Discounted Prices

Civil war and terrorism

- In most countries including USA and Europe

Economic risk

- Global debt $230 trillion – can never be repaid, nor financed when rates normalised

- Unfunded global liabilities $250 trillion – will never be honoured

- Central banks’ balance sheets $20 trillion – all insolvent

- USA insolvent – only supported by overvalued dollar and military

- China’s debt explosion from $2 trillion to $40 trillion since 2000 – massive bubble

- Most industrialised and emerging countries only survive with QE – untenable

- Interest rates at zero or below in 20 countries – unsustainable

- Paper money system – currencies going to zero.

Financial risk

- Global derivatives of $1.5 quadrillion – will all implode as counterparties fail

- Bankrupt European banking system – unlikely to survive

- Over-leveraged global banking system 20x to 50x leverage

- Bubbles in most asset classes – Stocks, bonds, property

Political risk

- USA has a lame duck president – risk of irrational or no actions

- EU elite – unelected and unaccountable – destroying Europe

- Trend of globalisation and socialism – very dangerous for global stability

The above list of risks is certainly not conclusive.

To summarise in one sentence: The world is facing risk of major (nuclear) wars, economic and financial collapse, as well as political and social upheaval. The realisation of just one of these risks would be enough to change the world for a very long time. We live in a totally interconnected world and the danger is that the domino effect will trigger one event after the next until all the risks become reality.

But the world has become totally immune to risk. No market has priced in these risks. If they did, we would not have stock, bond and property markets at historical highs and overvaluations. Central banks have succeeded in alchemy for such a long time that markets totally ignore risk. It seems that unlimited money printing, credit expansion, interest rate manipulation and currency debasement is the permanent solution for a world living above its means. But to totally fool the people, news must also be manipulated and this is where fake news comes in. Financial and economic figures must be massaged and the basis of the calculations constantly changed.

A NEW PARADIGM OR THE BIGGEST CRISIS IN HISTORY?

So here we stand in front of the biggest crisis that the world has ever encountered and no one is the slightest bit concerned. If market participants understood risk, they would already have taken cover in some deep (Swiss) bunkers. Instead the world is continuing to buy massively overvalued tech stocks, properties, crypto currencies and other assets. They will soon have the shock of their lifetime.

But this speculative mania is usually the norm at the end of a bubble era. Before the 1929 crash and 1930s depression, optimism was at a peak and both market participants and politicians were certain that this was a new paradigm which would continue for ever.

CURRENCY MARKETS REVEAL THE TRUTH

Whilst most financial markets are not worried about risk currently, the currency market is quietly reflecting the world’s view of the US economy and markets as well as the US political situation.

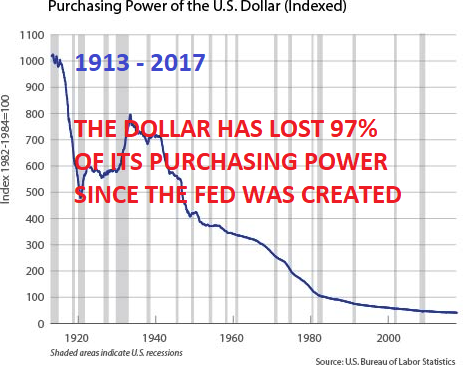

The Forex market is very difficult to manipulate. With daily global volume of over $5 trillion, no single central bank can move this market. Concerted central bank forex manipulation has worked in the past. But the days of cooperation are gone. Today every country wants to debase its currency. This is why we are seeing constant competitive devaluations in a race to the bottom. In the last 100 years, all currencies have lost 97-99% of their purchasing power. The final move to zero will probably take place in the next 5-8 years. And that involves another 100% loss from here.

Most Americans don’t worry about the value of their currency. Therefore they are not aware, for example, that if they visited Switzerland in 1971, they would have received 4.30 Swiss Francs for 1 dollar. Today they receive 0.95 Swiss cents. This is a loss of 80% in purchasing power against the Swiss Franc since Nixon stopped the gold backing of the dollar. Currency moves reveal the economic (mis-) management of a country. The constant loss of value of the dollar against most other countries in the last few decades clearly depicts that the US is on the road to ruin. The dollar tells the truth and it tells an ugly truth. The remaining days of the dollar as the reserve currency of the world are very limited. The world doesn’t need a reserve currency and certainly not one which is in a chronic decline due to economic mismanagement. The days of the petrodollar are coming to an end. China and Russia will see to that.

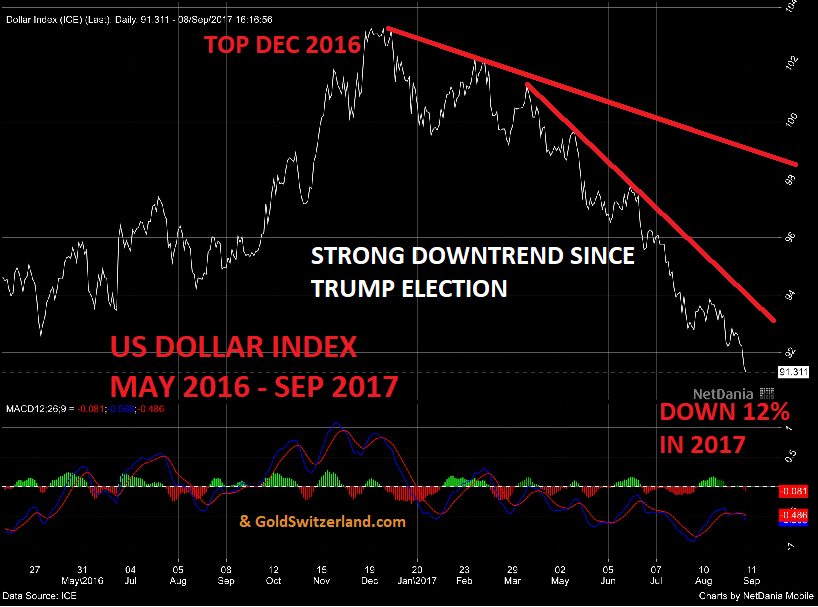

There is very little respect in Europe or in Asia for the current US political situation. There is even less respect for the economic situation in the US and its currency. Just after Trump was elected the dollar reacted in the opposite direction of US markets. The dollar peaked in December 2016 and is now down against all currencies. The dollar index for example is down 12% in 2017.

Copyright © 2017 Matterhorn Asset Management AG - GoldSwitzerland