The coming gold and silver moves in the next few months will really surprise most investors as market volatility increases substantially.

It seems right now that “All (is) quiet on the Western Front” as Erich-Maria Remarque wrote about WWI. Ten years after the Great Financial Crisis started and nine years after the Lehman collapse, it seems that the world is in better shape than ever. Stocks are at historical highs, interest rates at historical lows, house prices are booming again and consumers are buying more than ever.

HAVE CENTRAL BANKS SAVED THE WORLD?

So why were we so worried in 2007? There is no problem big enough that our friendly Central Bankers can’t solve. All you need to do to fool the world is to: Print and expand credit by $100 trillion, fabricate derivatives for another few $100 trillion, make further commitments to the people in forms of pensions and medical, social care for amounts that can never be paid and lower interest rates to zero or negative.

And there we have it. This is the New Normal. The Central Banks have successfully applied all the Keynesian tools. How can everything work so well with just more debt and liabilities? Well, because things are different today. We have all the sophisticated tools, computers, complex models, making fake money QE, interest rate manipulation management and very devious intelligent central bankers.

Or is it different this time?

All these shenanigans by central banks have created fortunes for the top 1% and massive debts for the rest of the world. For some of us who spend considerable time studying risk, you can make two very distinct conclusions:

- On the one hand, central bankers have been extremely skilful in using all the tricks in the book, including some new ones, and saved the world by printing unlimited amounts of money, expanded credit exponentially and abolished the cost of borrowing by setting rates at zero or negative. This is the perfect scenario and the Krugmans of this world must be really pleased since this justifies receiving the Nobel Prize and confirms that they have found the perfect method which can be applied indeterminately with great success.

- On the other hand, for the ones of us who believe that trees can’t grow to the sky and that sound money always prevails, we know that we are in the last stages of a bubble of epic proportions. Fortunately, our side has also received a Noble prize through von Hayek, although it was back in 1974.

This has been a very long battle between the manipulators and the advocates of sound money. With free money and socialism, you can fool most of the people for a very long time. But sadly for the Keynesians, they will run out of ammunition when all the printed currencies return to their intrinsic value of zero. This means you can’t fool all of the people all of the time. As Margaret Thatcher said: “The problem with socialism is that you eventually run out of other people’s money (OPM).”And this is exactly where we are today. The world has run out of OPM. When our company went aggressively into gold and silver in 2002 for our investors and ourselves, we did not believe that the central bankers would be able to manipulate markets for over 15 years. Still, silver was $4 at the time and gold $300, so the manipulation has only been partially successful.

MONEY PRINTING NO LONGER WORKS

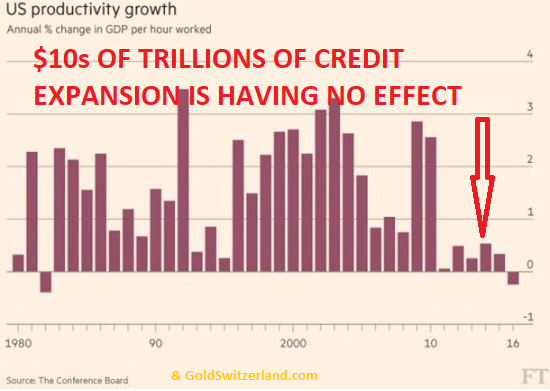

But the signs are now very clear that the money printing experiment is coming to an end very soon. Despite all the trillions of monies created in the world, real GDP has stopped growing.

As the chart below shows, all the money printing and credit expansion is no longer having an effect. Even a child could understand that you can’t grow an economy by printing paper and calling it money but for some reasons, the Keynesians seem to ignore the obvious.

MONEY PRINTING HAS BENEFITTED THE 1%

The only area which is still very strong is stock markets, property and bonds. This is where all the money printing goes and the 1% believe that their riches are exploding due to their investment skills. Little do they realise that these skills will just vanish into a big black hole in the next 4-7 years as the exploding assets implode and all the global debt with it. Sadly this must happen in order to create a sane world again. We cannot build a world on fake values and fake money. Mankind will not survive in such a world. It will totally destroy itself. It will be hard enough to survive the coming collapse of the Ponzi scheme that has flourished in the last 100 years.

The transition from a false system based on an illusion to real values and real money will be painful for most of the world. The wealthy will lose at least 95% of their assets and many normal people will starve and live in misery. We will have wars, civil unrest, political upheaval and economic devastation. This is what the elite has caused by creating a dishonest system for the benefit of the 1% but to the detriment of 99% of mankind. The problems we will see in coming years are likely to reduce world population by at least 1/3rd which is more than 2 billion people. The combination of wars, civil wars, famine, disease and economic collapse is likely to lead to this. World population has exploded from 1 billion to 7.5 billion in the last 160 years. Statistically there have always been setbacks in history when population has declined substantially whether it is due to wars or disease. During the Black Death of the 14th century for example, World population is estimated to have declined by 50%.

So the risks are major even though we are only talking about probabilities. Things could take longer and they could be less severe. But with risks of this magnitude, the very privileged few who have the possibility to take precautionary measures must do so. Because at some point in the next few years, a financial and economic collapse is inevitable.