My new book has been published and will be officially released on Tuesday. However, preorders for the e-Book version are now available on Amazon and can be obtained by clicking this link:

Trumped! A Nation On The Brink Of Ruin… And How To Bring It Back.

The central banks have gone so far off the deep-end with financial price manipulation that it is only a matter of time before some astute politician comes after them with all barrels blasting. As a matter of fact, that appears to be exactly what Donald Trump unloaded on bubble vision this morning:

By keeping interest rates low, the Fed has created a “false stock market,” Donald Trump argued in a wide-ranging CNBC interview, exclaiming that Fed Chair Janet Yellen and central bank policymakers are very political, and should be “ashamed”of what they’re doing to the country…

Trumped! A Nation on t...

Best Price: $2.05

Buy New $9.50

(as of 06:30 UTC - Details)

He’s completely correct. After all, they are crushing real wages with their 2% inflation targeting; destroying savers with NIRP and sub-zero rates, and burying unborn taxpayers in monumental debts that today’s politicians are pleased to issue with reckless abandon because the short-run carry cost is nil.

Trumped! A Nation on t...

Best Price: $2.05

Buy New $9.50

(as of 06:30 UTC - Details)

He’s completely correct. After all, they are crushing real wages with their 2% inflation targeting; destroying savers with NIRP and sub-zero rates, and burying unborn taxpayers in monumental debts that today’s politicians are pleased to issue with reckless abandon because the short-run carry cost is nil.

Interest on the Uncle Sam’s $19.4 trillion of debt, for example, is easily $500 billion lower than its true economic cost based on a normal yield after inflation and taxes and elimination of the phony $100 billion per year in so-called Fed “profits” that are booked by the treasury as negative interest expense.

Alas, when interest rates eventually normalize, the Treasury’s debt service costs will soar by hundreds of billions. At the same time, the entirety of the Fed’s “profits”, which are conjured from thin air because it buys interest-yielding government and GSE debt with printing press liabilities which cost virtually nothing, will disappear. That’s because it will be forced to take reserve charges for giant principal losses on the falling prices of its $4.5 billion portfolios of government and GSE bonds.

Physical Gold & Silver in your IRA. Get the Facts.

At that moment, the long-abused citizens of Flyover America, who have already been clobbered as savers and wage earners, will get hit with the triple whammy of soaring Federal tax bills. And this is not a matter of if or even when; it’s really just a question of how soon.

When it comes to the establishment’s monetary lunacy, of course, Mario Draghi’s is always leading the charge. So just consider what has been happening after his inartful punt during last week’s ECB meeting.

First, the casino cheerleaders have insisted that there is nothing to sweat about with respect to the incredible anomaly that now plagues the euro-bond markets. To wit, socialist Europe has apparently not issued enough qualifying debt (with a yield not below the negative 0.4% threshold) to fill the ECB’s $90 billion per month purchase target.

The solution is real simple according to Draghi’s acolytes in the casino. In addition to lowering the bond yield threshold as deep into the subzero freezer as necessary, they have proffered an even better solution. Just buy up the stock market, too!

“The obvious reason for the ECB to buy equities is they have almost run out of German bonds to buy,” said Stefan Gerlach, chief economist at BSI Bank and a former deputy governor of Ireland’s central bank. “The basic idea is that the central bank can put essentially anything on its balance sheet and there is no reason to be straight-laced about this.”

Equities offer a deep pool of assets. The market capitalization of listed eurozone companies was $6.1 trillion at the end of 2015, according to World Bank data.

And this isn’t just some whacko sell side analyst talking his book. Here’s what one of the world’s alleged leading monetary policy exports added to the mix:

When policy rates approached zero, central banks in the U.S., the U.K., Japan and the eurozone turned to bond purchases to reduce long-term interest rates. Buying equities would likely yield some of the same effects in terms of encouraging consumption and investment through higher household wealth and lower cost of capital.

“I don’t see a reason not to do this,” said Joseph Gagnon, senior fellow at the Peterson Institute for International Economics. “It isn’t obvious to me why a central bank wouldn’t always want a diversified portfolio, including equities.”

Actually, it gets even better. According to another casino player, bonds have now gotten so over-valued—-from massive central banking QE purchases, of course—-that European equities are now “undervalued” in relative terms!

Therefore, the ECB can do no less than plunge into a stock buying bacchanalia in order to set things right.

ECB stock purchases “would be justified: European equities are undervalued, while there is a bubble—that the ECB continues to inflate—in bonds,” said Patrick Artus, chief economist at French investment bank Nataxis in a research note.

Besides that, the Swiss National Bank (SNB) and the BOJ have already pioneered the way. Fully 20% of the former’s bulging portfolio consists of equities, including massive holdings of US stocks. And when we say “massive” that’s exactly what we mean.

The balance sheet of the SNB is up by nearly 7X since the eve of the financial crisis and now totals $715 billion. That happens to be 108% of Switzerland’s GDP.

It also happens to mean that in order to fight off the exchange rate impact of Mario’s relentless campaign to trash the Euro, the Swiss monetary central planners have purchased upwards of $150 billion of global equities, making them one of the largest hedge funds in the world.

Now that the Donald has extended his talk about the “rigged” system run by our unelected financial elites to include the stock market, he surely has a point.

Nor is the SNB an outlier. The BOJ also has roughly $150 billion of equities on its balance sheet. Indeed, it already owns 55% of all Japanese ETFs; is now among the top 10 shareholders in 90% of Japan’s 225 largest companies; and is slated to become the top holder in 40 of the Nikkei 225 companies by year-end 2017 at its planned stepped-up ETF purchase rate.

But the insanity of buying up and thereby falsifying large sections of the stock and bond markets in order to pursue the will-o-wisp of 2% inflation isn’t the half of it. Having done this, the central banks have made themselves hostage to the most reckless fast money speculators in the entire casino.

That’s because the latter will sell at a moments notice anything they have been front-running via leveraged carry trades if they think the central banks’ buying binge will stop.

In the case of Japan’s 30-year bond, for example, the yield in the last few weeks has soared from 6 bps to 61 bps on fears that the BOJ may “pause” its madcap bond buying program. Since it has already purchased more than 40% of Japan’s monumental public debt, the mere hint that it might stop caused the price of the 30-year bond to plunge by upwards of 20%.

But the recent dislocations in the euro-bond market leave nothing to the imagination. Draghi’s failure last Thursday to unequivocally state that the ECB’s $90 billion per month QE program would be extended after its scheduled expiration next March shows exactly why the central banks have turned themselves into monetary doomsday machines:

Meanwhile, yields on 10-year German Bunds turned positive for the first time since June 22. Yields were around 0.013 percent at the time of the market close, up from -0.06 percent on Thursday.

“The jolt across bond markets began when ECB president Mario Draghi said the governing council did not discuss extending its asset purchase program.Understandably, bondholders got a little nervous about holding onto a negative-yielding asset which could fall in price if there’s no central banking buying alongside them,” Jasper Lawler, market analyst at CMC Markets, said in a note on Friday.

There is all the evidence you need that the world’s financial markets are totally and completely rigged. And that’s why Donald Trump was exactly on target this morning when he uncorked another politically incorrect observation about the rigged nature of the Wall Street casino.

To wit, Yellen is still sitting on interest rates at the zero bound after 93 months for one simple reason. Even in the context of an economic recovery that is now allegedly so complete that we are actually on the cusp of full employment, according to Vice-Chairman Stanley Fischer, she is deathly fearful of a hissy fit on Wall Street, as was foreshadowed by last Friday’s sharp sell-off.

Opined the Donald:

“She’s obviously political and she is doing what [President Barack] Obama wants her to do,” Trump said in an interview on CNBC. Trump predicted that the market is going to “go way down” as soon as interest rates go up.

“I believe it is a false market because money is essentially free,” Trump said.

He got that right but needs to take it a step further. At the same time that the Fed continues placating Wall Street gamblers with an unending stint of free carry trade funding that has self-evidently not generated real breadwinners jobs or higher real incomes in Flyover America, savers and retirees continue to be pounded.

In fact, our unelected monetary politburo is causing upwards of $300 billion per year to be transferred from savers to the banks and the financial system owing to its senseless pursuit of 2.00% inflation via pegging the money market interest rate on the zero-bound.

Even then, however, the true impact goes far beyond retirees and the modest share of the population that actually attempts to save. To wit, 2% inflation targeting is absolutely the stupidest thing any central bank could pursue in the context of a global economy is which goods and services are freely traded, and in which the US, Europe, and Japan have the highest nominal wage rates on the planet.

What inflation targeting does is cause the domestic price level to rise, rather than fall, in DM economies. It thereby also causes the nominal wage gap with China and its EM supply chain to widen. So the Donald is right on that one, too.

Indeed, the most potent agency of off-shoring American jobs is not the USTR or bad trade deals, but the central banks. And in the middle and lower ranks of the wage market—-where the China price on goods and the India price on services bears down most heavily—-the Fed’s inflation folly is especially perverse.

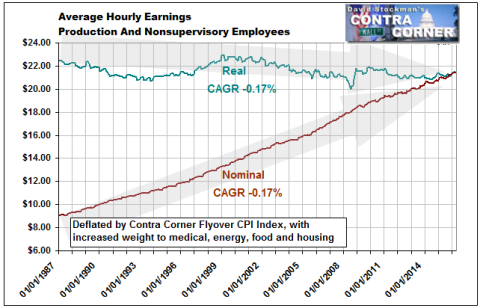

As we have demonstrated with our more accurate “Flyover CPI”, the cost of living faced by main street America—especially for the four horsemen of food, energy, medical and housing prices—has risen by 3.1% annually since the late 1980s. And that is well more than hourly wage gains for production workers.

So the Fed has delivered to working class Americans the worst of both worlds. Namely, rising nominal wages which have priced them out of the world market, but even higher domestic inflation that has caused their real wages and living standards to shrink.

Here is the smoking gun. Notwithstanding a near tripling of the nominal wage rate from $9 per hour in 1987 to about $22 per hour today, real wages are lower than they were three decades ago.

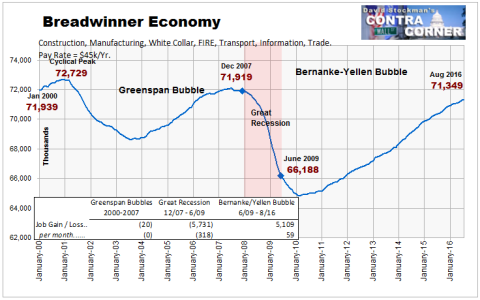

At the same time, the tripling of nominal wages has caused a relentless export of breadwinner jobs in goods and services to the China price and India price regions of the world. That’s why, in fact, there were still 1.4 million fewer full-time, full-pay breadwinner jobs at $50k per year in August than there were way back when Bill Clinton was packing his bags to shuffle out of the White House in January 2001.

In short, the “something for nothing” money printing policies inflicted on Flyover America by our unelected rulers at the central banks, and with the full support of their facilitators and supporters among the Wall Street/ Washington ruling elites, are not only bad economics; they are perverse and unjust beyond measure.

Indeed, the Fed is waging an insensible and outrageous war on savers, workers, and future taxpayers—even as it pleasures the 1% with fantastic financial windfalls from the Wall Street casino.

Now that is a rigged system. And that is a beltway evil that merits Donald’s unrelenting attack on behalf of the citizens of Flyover America who have been left behind in their tens of millions.

Reprinted with permission from David Stockman’s Contra Corner.