Real GOLD versus Pokémon GO? That’s a simple choice for most people because shortly after launch there are already more than 30 million users of the game Pokémon GO (PG). Gold has not for a long time attracted the same interest but that is likely to change in the next few months and years. Not that gold and PG in any way are competing in the same marketplace.

In today’s virtual world, a new ground-breaking virtual game will always attract more interest from the average individual than gold. Whilst gold is a barbarous relic as John Maynard Keynes called it, PG is what the world is all about today, fantasy and dreams. Also, PG is so real that the players don’t know if it is fiction or factual. What makes PG different is that it is played in the real world, walking around using your mobile phone’s GPS and trying to find virtual monsters like Pikachu and Jigglypuff who are on a street near you. Players are chasing down the street running into real cars and fences.

Governments issue virtual and worthless bonds in a giant swindle

In many areas of society, the border between the “REAL” world and virtual reality is very fuzzy. In the investment world, virtual reality has to a great extent replaced investing in “real” things. We have the world full of virtual money, virtual investments, virtual gold and virtual wealth. Money used to be backed by gold but that is a totally outdated concept. Today governments and central bankers can fabricate any amount of money which is not backed by anything. Instead, they print a piece of paper that they call money and simultaneously they issue a piece of paper that they call a government bond or treasury. In the UK these government bonds are called gilts, giving the impression they are backed by gold. But sadly the only gold is the gilded edge of these bonds. Government bonds are IOUs with a promise to pay. But practically all governments are lying to their people when the issue these bonds because they know that they will never be repaid with real money. Thus governments are swindling their people in the biggest Ponzi scheme in history which approaches $100 trillion worldwide.

Myths, Misunderstandings and Outright lies about owning Gold. Are you at risk?

But not only will governments never repay their debts, they have now reached a stage when they can’t even afford to pay the interest on these bond and therefore the yield on most governments securities is either zero or negative. It is totally incomprehensible that an investor can buy a bond with a zero yield or negative interest and which will never be repaid. To paraphrase Mark Twain:

“I am as concerned about the lack of return ON my money as the return OF my money.”

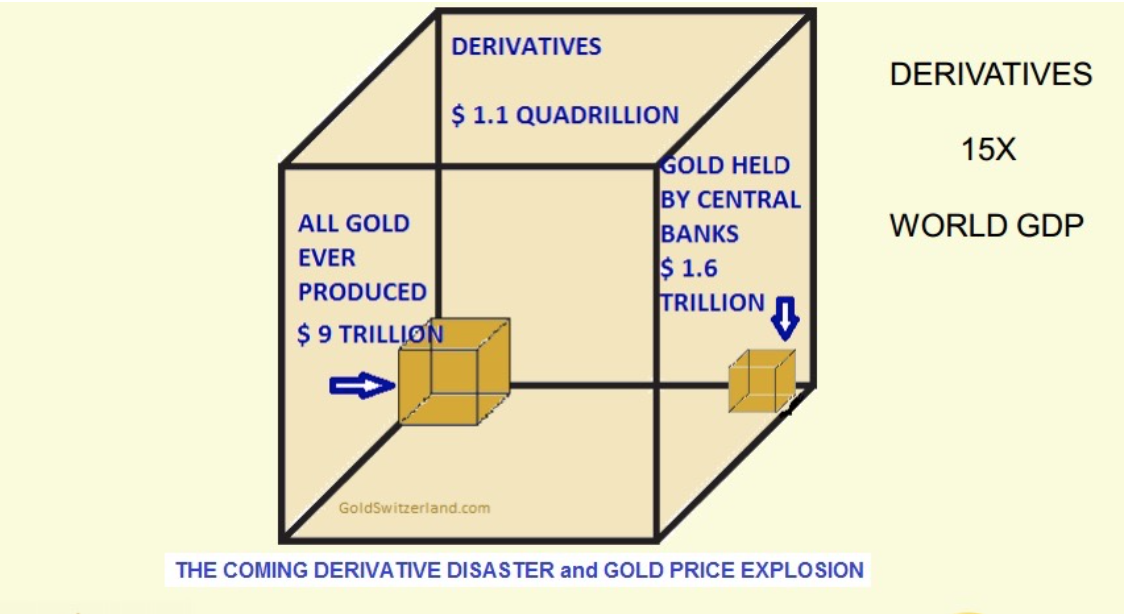

A $1.5 Quadrillion Bubble

Realistic games like PG contribute to making the virtual world ever closer to the real world. This is why investors are happily buying ETFs, futures, or paper gold. The biggest percentage of investments today are virtual or derivatives. This means that there are no underlying real assets but just pieces of paper that are likely to mature worthless in coming years. In addition to most ETFs which are synthetic, there are $1.1-1.5 quadrillion derivatives outstanding. Most of these are only virtual which means that they have no real value and are likely to mature worthless.