The central banks are leading the world into a black hole and have no idea what a disaster they have created. What initially seemed like a nice money spinner for the private bankers in 1913 when the Fed was set up has resulted in a $2 quadrillion (at least) monster that is now totally out of control.

Banks and central banks are experts at forging money

During the last hundred years, the Ponzi scheme seemed to work beautifully under the guise of Keynesianism. So whenever there was a problem in any economy in the world, all that was needed was some stimulus in the form of credit or forged money creation. And there are so many ways to forge money.Through the unlimited flexibility of the fractional banking system, money printing became a perfect perpetual motion system whereby the more credit that was created the more credit and paper money could be issued by the banks. There is absolutely no limit to how much money could be printed.

So banks and central banks have been in collusion to print or forge paper money which has no value and no asset banking. Any private individual doing the same would spend the rest of his days in jail. But when the bankers do it, it creates massive wealth and respectability for them since they have the full backing of governments. What a rotten world!

Can Deutsche Bank survive?

Instant Access to Current Spot Prices & Interactive Charts

Thus, it is a fallacy to believe that governments and central banks are the only money printers. Most of the false wealth is created by commercial banks that blow up their balance sheets 10 to 50 times. And if derivatives are included the bank’s exposure can be over 100 times the equity. Take Deutsche Bank for example; the total balance sheet exposure is 25 times equity. Adding their derivatives exposure of €68 trillion, Deutsche’s leverage is 100 times share capital and reserves. This means that a depositor hoping to get his money back from the bank should be aware that any loss above 1% of Deutsche’s assets would make them bankrupt. There is obviously no question that Deutsche will lose only 1%. They are virtually guaranteed to lose more than 10% and probably at least 50% of total assets which means that if you are a depositor you will definitely not get your money back. Most European banks are in a similar position and so are many US banks including JP Morgan, Bank of America and Citigroup. And don’t believe that Japanese, Chinese or Emerging Market banks are in a better position. This is, of course, the reason why most major banks’ share prices have fallen 75-95% since 2006.

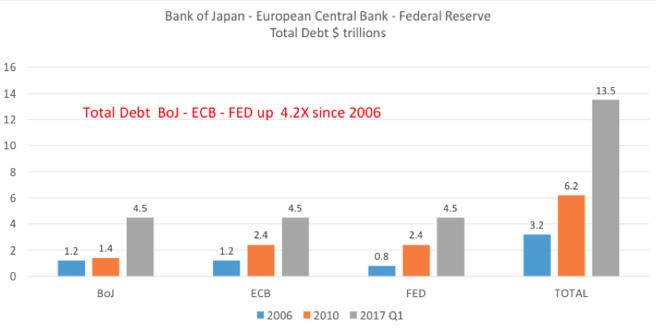

Central banks’ balance sheets have exploded since 2006

Governments and central banks were virtually bankrupt in 2006, which is when the fraud of central banking was finally revealed to the world after almost 100 years of manipulation and abuse. Nothing, no absolutely nothing has been mended since then. With propaganda, more money printing, and interest rate hocus pokery, the world economy has been dragged forward like a fatally wounded creature. The outcome has always been certain but the road there has been long and painful. Yes, a minuscule minority of much less than 1% of the world population has continued to benefit greatly whilst the masses have been burdened with another $100 trillion in debt plus unfunded liabilities and derivatives of much more than that. And most major central banks have blown up their balance sheets by more than four times since 2006. If we just take the Bank of Japan, ECB, and the FED, their total balance sheets are expected to increase from $3.2 trillion in 2006 to $13.5 trillion in Q1 of 2017. Although this increase of “only” $10 trillion is a drop in the ocean compared to the total increase in debt, these central banks set the trend through their irresponsible policies. The assets that these three central banks hold will be totally worthless in the next 5-7 years. But before that their balance sheets will expand exponentially in a final Keynesian attempt to save the global financial system from total implosion. This will lead to a short period of hyperinflation before the deflationary implosion of the system. Because you cannot solve a problem using the same method that created it in the first place, this will be the necessary total eradication of all debt. But it is not only debt that will disappear, most of the assets financed by this debt will also decline dramatically in value, leading to a massive destruction of wealth.

Central banks will, of course, attempt all the methods available to them before they give up. This will include not just money printing and more negative rates but also debt forgiveness, devaluations, moratoria, stealing pension funds and bank deposits, bail-ins plus many other tricks that will impoverish most ordinary people. Neither governments nor central banks will have any qualms about totally destroying the wealth of their people.