Talk about a double standard…

The US is quick to point fingers, yet hardly ever enforces its rules at home.

As I write this, the US is gripped by a domestic immigration scandal that dwarfs any reproach they’ve cast on others. It’s clear the standards it demands in countries with CBI (citizenship-by-investment) programs are much stricter than those it enforces at home.

In 2014, the US Treasury’s Financial Crimes Enforcement Network (FinCEN warned banks that the Federation of St. Kitts & Nevis (SKN) CBI program had been hijacked by “illicit actors.” They accused the Federation of issuing passports to Iranian citizens labeled “specially designated nationals” by the Treasury’s Office of Foreign Assets Control (OFAC).

Three Felonies A Day: ...

Best Price: $7.30

Buy New $1.99

(as of 11:00 UTC - Details)

Three Felonies A Day: ...

Best Price: $7.30

Buy New $1.99

(as of 11:00 UTC - Details)

Financial institutions were told they need more than a passport from the Federation to identify a customer. The advisory instructed them to verify identity:

… using a form of government-issued identification other than, or in addition to, the SKN passport, or using non-documentary methods that enable the financial institution to form a reasonable belief that it knows the true identity of the customer, including the customer’s country of origin.

The aftermath of this was a disaster for St. Kitts & Nevis.

Another country with a CBI program, Antigua & Barbuda also drew Uncle Sam’s attention. In 2015, Rep. Michael McCaul (R-TX), chairman of the House Committee on Homeland Security, accused Antigua of human trafficking and visa fraud.

No sanctions followed, and McCaul didn’t plainly condemn Antigua’s CBI program. But there’s no question that the US is closely monitoring these programs.

America’s immigration scandal, hinted at above, concerns abuses of the “Employment-Based Fifth Preference Immigrant Investor Program,” or EB-5.Authorized by Congress in 1990, this visa option is intended to finance infrastructure projects in rural areas and poor urban neighborhoods. It authorizes up to 10,000 visas annually to foreigners who invest in a US project that generates 10 or more jobs within two years.

Until about a decade ago, only a few dozen foreign investors used the EB-5 option each year. However, as domestic financing dried up during the 2007–2008 recession, developers turned to foreign investors seeking US residence for help. In 2015, for the first time, all 10,000 visas given to the EB-5 program were issued. Chinese nationals snapped up more than 80% of them.

Foreign investors can qualify for an EB-5 visa by investing $1 million in a new business or $500,000 through one of nearly 800 “regional development centers.” These centers are certified by the federal government to pool EB-5

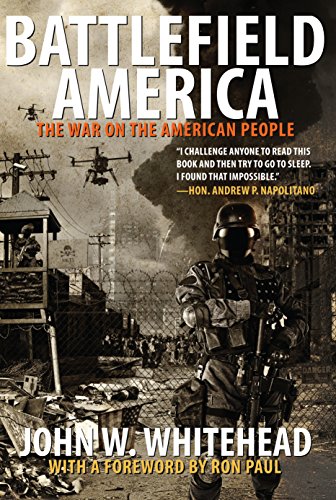

Battlefield America: T...

Best Price: $10.95

Buy New $18.80

(as of 10:15 UTC - Details)

investments. About 95% of EB-5 applicants invest through a regional center. After two years, successful EB-5 applicants get a green card. After five years, they can qualify for US citizenship and get a US passport.

Battlefield America: T...

Best Price: $10.95

Buy New $18.80

(as of 10:15 UTC - Details)

investments. About 95% of EB-5 applicants invest through a regional center. After two years, successful EB-5 applicants get a green card. After five years, they can qualify for US citizenship and get a US passport.

About three years ago, I attended an immigration-related conference in Miami where I learned more about the EB-5 option. One speaker said it’s almost impossible for a project not to qualify. The reason is the standards used to evaluate jobs created are almost laughably loose. That’s because Uncle Sam gives EB-5 investors credit for all jobs a project supposedly creates, even if EB-5 investments represent only a small portion of its financing.

As I looked into the program, I discovered examples of developers pocketing EB-5 investors’ money. A recent scandal involved a development project at Jay Peak, a Vermont ski resort. The SEC has charged the owner and president of Jay Peak with securities fraud for misusing at least $200 million raised through EB-5 investors. And that’s just one of many similar examples.

What’s more, The only real due diligence on EB-5 applicants consists of whether or not they have the funds required to invest. A 2013 investigation by the US Citizenship and Immigration Services (USCIS) warned the EB-5 program “may be abused by Iranian operatives to infiltrate the United States.” Investigators discovered individuals possibly tied to the Iranian and Chinese intelligence services had applied for EB-5 visas using fake documents.

A Government Accountability Office report released last summer echoes many of these concerns. It concluded that the USCIS could not be sure that money used for the visas was not coming from “drug trade, human trafficking, or other criminal activities.” Indeed, standards are so lax, the USCIS does not always enter the most basic information on EB-5 applicants, including their name and date of birth.

Getting Out: Your Guid...

Best Price: $2.25

Buy New $6.94

(as of 08:00 UTC - Details)

Don’t get me wrong. I’m not attacking the EB-5 program – far from it. Every nation has a right to grant incentives to highly qualified or wealthy applicants, and Congress has chosen this way to do it. What I object to is the double standard the US applies to CBI programs.

Getting Out: Your Guid...

Best Price: $2.25

Buy New $6.94

(as of 08:00 UTC - Details)

Don’t get me wrong. I’m not attacking the EB-5 program – far from it. Every nation has a right to grant incentives to highly qualified or wealthy applicants, and Congress has chosen this way to do it. What I object to is the double standard the US applies to CBI programs.

Personally, I’d replace the EB-5 program with an auction-based system and let prospective immigrants bid for the right to live and work in the US. I suspect the winning bids would far exceed $500,000. While I suspect this idea might make Donald Trump smile, I don’t think most Americans would support it. It would, after all, be selling US citizenship.

But of course, that’s exactly what the EB-5 program is all about. It takes a little longer than a CBI program, but after five years, a green card holder living in the US can apply for citizenship and get a US passport.

If nothing else, the EB-5 program and the abuses accompanying it prove the truth of the other “Golden Rule”: He who has the gold makes the rules. So, while the US Treasury can send out advisories criticizing potential abuses in Caribbean CBI programs, a very different set of rules applies at home.

Keep that in mind next time you read an article in the US press criticizing abuses or unfairness in another country’s CBI program. The Golden Rule, along with the double standard, is alive and well.

Reprinted with permission from Nestmann.com.