As I reported recently, banks are beginning to collaborate in the campaign by governments to stamp out the use of cash among the public. Chase, for example, rolled out a new program in several markets in March that restricts borrowers from using cash for making payments on credit cards, equity lines, mortgages and auto loans. Even more troubling is Chases’ revised policy governing the use of its safe deposit boxes. In a letter dated April 1, Chase informed its customers of the new policy, which included the following provision: “You agree not to store any cash or coins other than those found to have a collectible value.”

Jeff Thomas provides a provocative and worrisome speculative narrative on this development over at International Man. According to Thomas, if and when the War on Cash finally succeeds in channeling all transactions through the banking system,

Money, Sound and Unsound

Best Price: $31.95

Buy New $51.85

(as of 08:00 UTC - Details)

Money, Sound and Unsound

Best Price: $31.95

Buy New $51.85

(as of 08:00 UTC - Details)

. . . confiscations [of deposits] will occur. Again, these will be implemented by the banks. But in order to maximise the amount that will be taken, it will be necessary to force people out of other forms of wealth storage and into bank deposits.

Looked at in this light, the otherwise seemingly arbitrary restriction on cash and precious metals in safe deposit boxes makes complete sense. Should a bank perform a confiscation on accounts, whatever was in the safe deposit boxes would remain safe.

And even in a confiscation, banks would be reluctant to raid safe deposit boxes, as they would a) have to force them open, and b) have to deal in some way with the non-monetary contents of the boxes, such as documentation and fine art. To do so would glaringly expose the banks as plunderers (assuming the theft of deposits had not already achieved that end).

Meanwhile, there is a glimmer of hope in the State of Texas, where Texas House Bill HB483 has been passed by both the state house and senate, and now awaits the house vote on the amended senate version. The bill establishes a Texas State precious metals depository which would permit Texans to store and pay precious metals to other account holders. The depository will have a network of agents throughout the state who will accept deposits of gold,

Against the State: An ...

Best Price: $5.02

Buy New $5.52

(as of 11:35 UTC - Details)

silver, platinum, palladium, or rhodium. Depositors will also have check writing privileges enabling them to transfer precious metals or their dollar equivalent to third parties outside the banking system. The comptroller will publish exchange rates among the precious metals as well as between each metal and the U.S. dollar and other currencies but–and this is important–will not establish official exchange rates. Now granted, this is a governmental scheme, even if it is sponsored by the maverick State of Texas, but as one commentator half-jokingly observed:

Against the State: An ...

Best Price: $5.02

Buy New $5.52

(as of 11:35 UTC - Details)

silver, platinum, palladium, or rhodium. Depositors will also have check writing privileges enabling them to transfer precious metals or their dollar equivalent to third parties outside the banking system. The comptroller will publish exchange rates among the precious metals as well as between each metal and the U.S. dollar and other currencies but–and this is important–will not establish official exchange rates. Now granted, this is a governmental scheme, even if it is sponsored by the maverick State of Texas, but as one commentator half-jokingly observed:

Everywhere it [i.e., an electronic gold & silver payments system] has been tried, the US government has fought it bloody tooth and nail, nationally and internationally, & sought to stop it by criminal prosecutions & regulations.

Now Texas steps forward to make it stick. And if Texas has nerve to carry through, it could make Texas a center of world finance to rival New York and London — Better than Switzerland because it is home to 27,695,284 Texans and all but two of ’em are armed and serious.

7775 1.8 CF Large Elec...

Buy New $132.10

(as of 01:20 UTC - Details)

7775 1.8 CF Large Elec...

Buy New $132.10

(as of 01:20 UTC - Details)

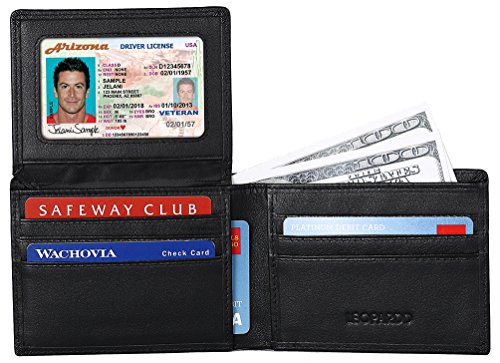

Leopardd Men’s B...

Buy New $21.99

(as of 02:30 UTC - Details)

Leopardd Men’s B...

Buy New $21.99

(as of 02:30 UTC - Details)

Southwest Specialty Pr...

Check Amazon for Pricing.

Southwest Specialty Pr...

Check Amazon for Pricing.