On 30 November 2014 the Swiss People has the opportunity to determine not just the fate of their own financial system but also to be the catalyst for the return to sound money in the Western World.

The “Gold Initiative” referendum November 30, 2014

On November 30th the Swiss will vote on:

- Returning their national gold which is held abroad back to Switzerland

- Requiring the Swiss National Bank to hold 20% of their assets in physical gold

- Prohibiting further gold sales

So why is this referendum so important? Because Switzerland has, for hundreds of years, been a bastion of sound monetary policy and low inflation. But this has gradually changed in the last 100 years since the creation of the Fed in the US and especially during the past 15 years when the Swiss government quietly removed the 40% gold backing from the revised Federal Constitution which was adopted by popular vote in 1999.

So why is this referendum so important? Because Switzerland has, for hundreds of years, been a bastion of sound monetary policy and low inflation. But this has gradually changed in the last 100 years since the creation of the Fed in the US and especially during the past 15 years when the Swiss government quietly removed the 40% gold backing from the revised Federal Constitution which was adopted by popular vote in 1999.

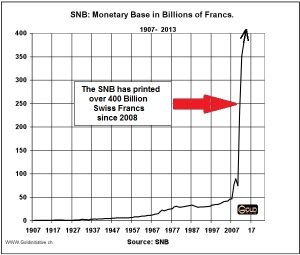

No paper currency has ever survived throughout history in its original form. And the Swiss Franc from having been a strong currency is now in the process of being slowly destroyed by the recent policies of the Swiss National Bank (SNB).Since 2008 the SNB’s balance sheet has expanded 5 times from CHF 100 Billion to CHF 500 Billion. So Switzerland has printed around 400 Billion Swiss Francs in the last 6 years in order to hold its currency down against the Euro and other currencies. CHF 400 Billion is around 2/3 of GDP.This means that Switzerland has printed more money, relatively, than any major country in the world in the last 6 years.

Why this change of policy?

For a very long time, the Swiss Franc appreciated against most currencies and Switzerland prospered with a strong economy, strong currency and lower inflation than most major countries. It is of course a fallacy to believe that a weak currency benefits a country when Switzerland has proved that the opposite is the case.

Between 1970 and 2008 the Swiss Franc appreciated by 330% to the dollar and 57% to the DM/Euro. So for almost 40 years a very strong Swiss currency went hand in hand with a strong economy. In spite of this proven success, the new guard in the SNB decided to abandon proven successful policies and print money like most other countries.

To tie the Swiss Franc to a weak currency like the Euro and a very weak economic area like the Eurozone is a recipe for disaster. To align your country to a failed political and economic experiment can only lead to failure.

Swiss Banks – Highly leveraged

But it is not only the SNB that is now following unsound policies but so are the big Swiss banks. From an equity ratio of 15-20% 100 years ago, the big Swiss banks are now down to 2-3.5% (note: because the basis of calculation changed after 2007 it is difficult to make an exact comparison). This means that the big Swiss banks have a leverage ratio of 30-50. Thus a loss in their loan book of 2-3% would be enough to wipe out the entire bank. It is virtually certain that when interest rates go up, the Swiss banks will have losses on the balance sheet or on derivatives that are considerably higher than 2-3%.

The SNB and the Swiss banks are already too big to save in relation to the size of the Swiss economy. Continued expansion of the balance sheets of the SNB and the Swiss banks is likely to lead to a very vulnerable positon for the Swiss economy and currency. With another crisis like in 2007-9, the SNB would have to print unlimited amounts of money which would destroy the value of the Swiss Franc, leading to high inflation or even hyperinflation. With both the SNB and the Swiss banks on a dangerous path, Switzerland now has the unique opportunity to return to a sound financial system that has been their trademark for centuries.