Foreclosure-gate is heating up and the mad scramble for what’s left of $45 trillion in real estate is guaranteed to leave homeowners homeless, pension funds unable to pay their pensions and even some of the biggest banks insolvent. A great housing goat rodeo was created when some of the 65 million mortgages on U.S. homes didn’t follow proper legal procedures:

- Fraud by homeowners who lied on their loan applications

- Fraud by banks who didn’t follow proper legal procedures around the notarization and processing of mortgage documents

- Fraud by investment banks who packaged this junk and resold it to unsuspecting pension funds

- Pension funds promised returns to their pensioners they could never achieve

Crash Proof 2.0: How t...

Best Price: $1.50

Buy New $3.97

(as of 10:46 UTC - Details)

Crash Proof 2.0: How t...

Best Price: $1.50

Buy New $3.97

(as of 10:46 UTC - Details)

Lies, lies, lies and more lies. In this jockeying for position, the only thing guaranteed is Leona Helmsley’s Law i.e. "Laws and taxes are for the little people". But the little people are starting to fight back in the U.S. and we’ll get to that after we do a quick review of the situation at hand and how we got there.

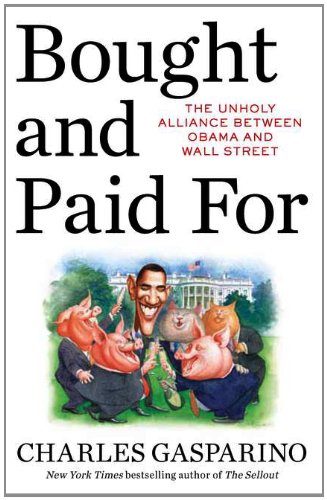

Bought and Paid For: T...

Best Price: $2.26

Buy New $3.82

(as of 04:40 UTC - Details)

Bought and Paid For: T...

Best Price: $2.26

Buy New $3.82

(as of 04:40 UTC - Details)

In the old days, that would be pre-1980’s, banks and savings and loans actually knew their customers and wrote and maintained loans on property themselves. Something similar to this scene from It’s a Wonderful Life where George explains to his depositors, who came to withdraw their money, where it all went:

In those days, the corner bank knew the customer, the house, the depositors, they kept the records in a file cabinet at the bank – it was where you went in to make your payment. Everyone knew that If you didn’t keep up with the payments, the banker would foreclose on your property. That part hasn’t changed.

In the 1980’s, financial geniuses came up with a new product, a way for the investment banks to make money from a market they couldn’t previously tap into in a big way – the home lending business. As you can imagine, it’s a huge market, in the trillions, and the way they approached this market was to convince the originating banks, those who process and write the loans, that they could get more access to cheaper money. This would let them write more loans, generate more fees and make more money by reselling the mortgage. It also eliminated a lot of the risk of the loan, since it was almost immediately resold. But buying an individual mortgage of several hundred thousand dollars wouldn’t make sense for the large investors with billions to invest or the investment banks, so they packaged them together in bundles of millions of dollars worth of mortgages.

The Ultimate Suburban ...

Best Price: $0.25

Buy New $5.49

(as of 10:46 UTC - Details)

The Ultimate Suburban ...

Best Price: $0.25

Buy New $5.49

(as of 10:46 UTC - Details)

One problem they had to solve was that many funds have rules on the quality of investment they could invest in; some funds can only invest in AA rated investments or better, others may have more flexibility. The investment banks then carved up these large packages of mortgages into tranches based on the pecking order of who got paid back first and they rated them based on credit score. As an example, the first 20% repaid would be rated AAA, then next 20% might be rated BB and so on. Each tranche represented a claim on the cashflow of the mortgages. The mortgages were supposedly scrutinized and the packaging was complete – it was called a Mortgage Backed Security (MBS). Here’s a little more detail from Wikipedia:

Ginnie Mae guaranteed the first mortgage passthrough security of an approved lender in 1968. In 1971 Freddie Mac issued its first mortgage passthrough, called a participation certificate, composed primarily of private mortgages. In 1981 Fannie Mae issued its first mortgage passthrough, called a mortgage-backed security. In 1983 Freddie Mac issued the first collateralized mortgage obligation.

In 1960 the government enacted the Real Estate Investment Trust Act of 1960 to allow the creation of the real estate investment trust (REIT) to encourage real estate investment. In 1977 Bank of America issued the first private label passthrough, and in 1984 the government passed the Secondary Mortgage Market Enhancement Act (SMMEA) to improve the marketability of such securities. The Tax Reform Act of 1986 allowed the creation of the tax-free Real Estate Mortgage Investment Conduit (REMIC) special purpose vehicle for the express purpose of issuing passthroughs. The Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA) dramatically changed the savings and loan industry and its federal regulation, encouraging loan origination. The Small Business Job Protection Act of 1996 introduced the Financial Asset Securitization Investment Trust(FASIT) that is similar to the REMIC but is able to securitize a wider array of assets.

Today, there are almost $9 trillion worth of mortgage related securities.

October 21, 2010