"Peter, you have been mocked on all of these financial shows going back to 2005. Going back to 2005! Not only did you predict problems, you actually explained what was going to happen. Why didn’t anybody listen? You were Cassandra!" ~ MSNBC commentator Joe Scarborough to "Austrian school" economics adherent Peter Schiff on Morning Joe, March 25, 2009 Scarborough’s reference to Cassandra — the character from Greek mythology given the gift of prophecy and the curse that nobody would believe her predictions — was particularly apropos to the Austrian school of economic theory until the latest economic crash. The name of this free-market economic school acknowledges the fact that many of the school’s "founding fathers" were Austrian nationals and disciples of the Austrian economist Karl Menger. Of course, the "Austrian school" is not a school in the traditional sense of the word denoting a physical structure; the term defines those who believe in pure free-market economics and laissez-faire principles. The Austrian school has a long history of amazingly accurate economic predictions while at the same time being completely ignored by the political establishment and virtually ignored by the mainstream media. Prescient Predictions

How an Economy Grows a...

Best Price: $1.99

Buy New $7.20

(as of 11:05 UTC - Details)

How an Economy Grows a...

Best Price: $1.99

Buy New $7.20

(as of 11:05 UTC - Details)

But that lack of credibility to the public faded entirely once the Austrian school’s predictions again came true. One of the few exceptions to the media blackout against the Austrian school before 2008 was Euro Pacific Capital President Peter Schiff, now a candidate for the U.S. Senate in Connecticut, who had given a number of television interviews in advance of the current recession. Schiff repeatedly pointed out with astonishing accuracy what would happen and — more amazingly — why it would happen. Among the more famous of these interviews was an August 28, 2006 CNBC-TV debate with Reagan-era "supply-side school" economist Arthur Laffer. Laffer, a famed economic advisor to President Reagan, is perhaps the most prominent of the supply-side theoreticians and best known for the "Laffer curve" that explains how government can extract the most taxes from taxpayers without choking economic activity. After hearing Schiff predict a severe recession in 2007 or 2008, Laffer replied:

What he’s saying is that savings is way down in the United States, but wealth has risen dramatically. The United States economy has never been in better shape. There is no income tax increase coming in the next couple of years. Monetary policy is spectacular. We have freer trade than ever before…. I think Peter is just totally off base, and I just don’t know where he’s getting his stuff.

Schiff replied: "When you see the stock market come down and the real estate bubble burst, all that phony wealth is going to evaporate and all that is going to be left is the debt we accumulated to foreigners." Laffer next bet Schiff a penny in the same interview that Schiff was wrong. Laffer claimed he hadn’t paid Schiff the penny on HBO’s October 24, 2008 Real Time With Bill Maher show. Schiff was not the only Austrian to accurately predict the current recession. Congressman Ron Paul made virtually identical predictions. Interviewed on February 23, 2010 — shortly after Paul won the Conservative Political Action Conference (CPAC) presidential straw poll on who conservatives would like to run for the next presidential election — on MSNBC’s Morning Joe, Scarborough noted:

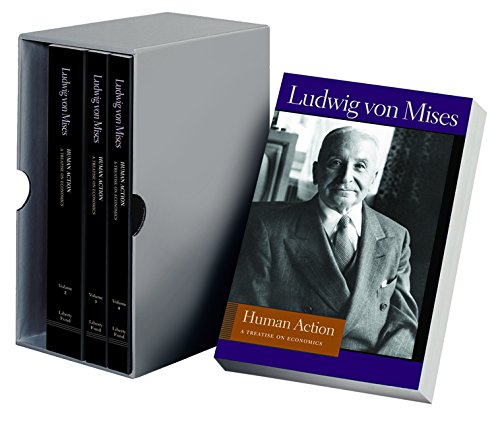

Human Action: A Treati...

Check Amazon for Pricing.

Human Action: A Treati...

Check Amazon for Pricing.

Here’s what Ron Paul predicted in 2003 about … the bubble that was growing through Fannie and Freddie and the banks: [Video clip] "Ironically, by transferring risk of a widespread credit default, the government increases the likelihood of a painful crash in the housing market. Like all artificially created bubbles, the boom in housing prices cannot last forever. When house prices fall, homeowners will experience difficulty, their equity will be wiped out. The more people who will be investing in the market, the greater the effects across the economy when that bubble bursts. Even Fed Chairman Greenspan has expressed concerns that government subsidies make investors underestimate the risk of investing in Freddie and Fannie." You called it right. That was in 2003, Congressman. 2003, five years and five days before the crash. How did you know?

Actually, Rep. Paul had also said essentially the same thing a year earlier than that, in a July 16, 2002 speech before the U.S. House of Representatives. How did he know? Representative Paul explained to Scarborough that he was

just trying to understand economics from an Austrian free market perspective. It sort of goes to show that with a little perseverance sometimes you can come as a winner in the end. And I think we are winning on arguing the case for free markets over government intervention…. It isn’t me that makes these predictions, it’s the predictions made by good Austrian economists, people like Mises and Hayek and Rothbard and Sennholz. They taught us this, it’s available, and the young people especially are responding to this and studying this school of thought.

Austrian school economics received a massive national hearing during Rep. Paul’s presidential race in 2008, though — like Cassandra — his predictions of an economic crash were not accepted by enough Republican Party primary voters to win him the presidential nomination. That has all changed since the crash, Rep. Paul told The New American in an interview for this story. He sees a rising interest in the Austrian school: "There has been a dramatic change with the collapse in the economy because the Austrians predicted it. They’ve been right before."

Man, Economy, and Stat...

Best Price: $22.75

Buy New $25.00

(as of 07:50 UTC - Details)

Man, Economy, and Stat...

Best Price: $22.75

Buy New $25.00

(as of 07:50 UTC - Details)

He’s right on both counts. The media is covering Austrian economists more than ever. Rep. Paul has been a frequent guest on national television and enjoyed two national best-selling books, The Revolution: A Manifesto and End the Fed, since losing the Republican presidential nomination. His "Campaign for Liberty" — a non-political interest group founded to continue the grass-roots activism of mostly younger 2008 campaign volunteers — received more than $4 million in donations in just the first few months after President Obama was elected. Rep. Paul acknowledges that "the campaign lit a match." But he’s quick to add that "the work was done many many years ago," by Ludwig von Mises and others. Found to Be Fundamentally Sound

Rep. Paul is correct about the Austrian school making accurate forecasts in the past in addition to analysis of the most recent recession. Austrian school economist Friedrich A. von Hayek predicted the Great Depression years in advance of the infamous 1929 Wall Street stock market crash. Hayek’s Monetary Theory and the Trade Cycle — first published from Austria in 1929 — predicted the Great Depression. Hayek was granted a Nobel Prize in Economics (much later, in 1974) for his pre-Depression and Depression-era related work in the study of economics. The Nobel committee explained in a press release about the award:

Perhaps, partly due to this more profound analysis, he was one of the few economists who gave warning of the possibility of a major economic crisis before the great crash came in the autumn of 1929. Von Hayek showed how monetary expansion, accompanied by lending which exceeded the rate of voluntary saving, could lead to a misallocation of resources, particularly affecting the structure of capital. This type of business cycle theory with links to monetary expansion has fundamental features in common with the postwar monetary discussion.

The Left, The Right an...

Best Price: $7.33

Buy New $40.00

(as of 07:55 UTC - Details)

The Left, The Right an...

Best Price: $7.33

Buy New $40.00

(as of 07:55 UTC - Details)

Originally written during 1928 — and published in the German language in 1929 — Monetary Theory and the Trade Cycle provided the theoretical models that proved an economic crash was coming in the United States and other countries. The June 1932 preface to the English edition explained more specifically that the Federal Reserve had continued an inflationary, easy-credit policy under the Hoover administration (further continued and accelerated by the Roosevelt administration) that was bound to drag out the Depression: "Far from following a deflationary policy, central banks, particularly in the United States, have been making earlier and more far-reaching efforts than have ever been undertaken before to combat the depression by a policy of credit expansion — with the result that the depression has lasted longer and has become more severe than any preceding one." The acceleration of that easy-credit policy under the Roosevelt administration guaranteed that the Great Depression would last until the end of World War II (though the war itself "cured" the unemployment part of the depression). And for many Austrians, today’s Federal Reserve policies are mirroring those of the early 1930s.

Hayek’s “trade cycle” is today called the “business cycle” by most Austrians, who use a term called “praxeology” to describe their approach. Praxeology is simply a word of Greek derivation employed by the Austrian school that means “the study of human action.” The action being studied in this case is economic action of a people. Austrian school economists understand the common-sense principle that nations — like people — build wealth from savings and investment and not from borrowing and spending.