If you’re a trader, you’re a loser.

That’s what a Journal of Finance study found.

As the two Journal of Finance researchers said in their article, "Trading is hazardous to your wealth."

They studied over 66,465 online trading accounts for a period of six years, from 1991 through 1996. They found that the average trader’s returns were about 6.5% less than the overall market. That’s even worse than most mutual fund managers, who routinely do about 4.8% worse than the market.

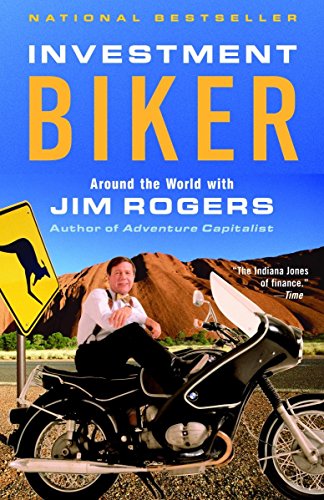

Investment Biker: Arou...

Best Price: $1.56

Buy New $8.63

(as of 10:55 UTC - Details)

Investment Biker: Arou...

Best Price: $1.56

Buy New $8.63

(as of 10:55 UTC - Details)

Nobody ever tells you that actively trading in and out of stocks every day is too risky and too hard for most people. And the more active the average trader is, the more he loses.

For one thing, there’s too much competition. As a trader, you must compete against gigantic firms, like Goldman Sachs, that have billions of dollars of trading capital and armies of people sifting through mountains of information — information they often get before anyone else. Their executives are in touch with the highest levels of government around the world. No wonder traders do so poorly on average.

Another thing is, most traders have no idea that they should use small position sizes and strict stop losses. They take huge risks against the Goldman Sachs of the world… so one bad trade blows them out of the water.

Adventure Capitalist: ...

Best Price: $0.25

Buy New $8.76

(as of 01:05 UTC - Details)

Adventure Capitalist: ...

Best Price: $0.25

Buy New $8.76

(as of 01:05 UTC - Details)

There’s a much better alternative to getting involved in all this action…

Building enormous wealth in the stock market is possible — and it’s not nearly as complicated as Wall Street, CNBC, and a zillion newspapers and magazines would have you believe.

If you want to get rich investing, you should listen to someone who has actually done it. Jim Rogers knows. Rogers wrote Investment Biker, about how he drove around the world on a motorcycle, looking for new investment ideas. He’s not sitting in front of a computer trading his online brokerage account all day.

Here’s what Roger’s says you should do to get rich:

Take your money, put it in Treasury bills or a money-market fund. Just sit back, go to the beach, go to the movies, play checkers, do whatever you want to.

Then something will come along where you know it’s right. Take all your money out of the money-market fund, put it in whatever it happens to be and stay with it for three or four or five or 10 years, whatever it is.

You’ll know when to sell again, because you’ll know more about it than anybody else. Take your money out, put it back in the money-market fund, and wait for the next thing to come along. When it does, you’ll make a whole lot of money.