In Part One of this article I laid the groundwork of the Fourth Turning generational theory. I refuted President Obama’s claim that the shadow of crisis has passed. The shadow grows ever larger and will engulf the world in darkness in the coming years. The Crisis will be fueled by the worsening debt, civic decay and global disorder. I will address these issues in this article.

Debt, Civic Decay & Global Disorder

The core elements propelling this Crisis – debt, civic decay, and global disorder – were obvious over a decade before the financial meltdown catalyst sparked this ongoing two decade long Crisis. With the following issues unresolved, the shadow of this crisis has only grown larger and more ominous:

Debt

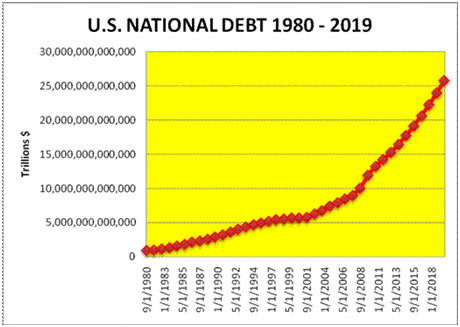

- The national debt has risen by $7 trillion (64%) to $18.1 trillion since 2009 and continues to accelerate by $2.3 billion per day, on track to surpass $20 trillion before Obama leaves office and $25 trillion by 2019.

- The national debt as a percentage of GDP is currently 103% (it would be 106% if the BEA hadn’t decided to positively “adjust” GDP up by $500 billion last year). It is on course to reach 120% by 2019. Rogoff and Reinhart have documented the fact countries that surpass 90% experience economic turmoil, decline, and ultimately currency collapse and debt default.

- Despite the housing collapse and hundreds of billions in mortgage, credit card, auto, and corporate debt being written off, dumped on the backs of taxpayers and hidden on the Federal Reserve balance sheet, total credit market debt has reached a new high of $58 trillion.

- Harvard professor Laurence Kotlikoff has been a lone voice telling the truth about the true level of unfunded promises hidden in the CBO numbers. The unfunded social welfare liabilities in excess of $200 trillion for Social Security, Medicare, Medicaid, and Obamacare are nothing but a massive future tax increase on younger and unborn generations. Kotlikoff explains what would be required to pay these obligations:

The Fourth Turning: An...

Best Price: $7.92

Buy New $12.04

(as of 08:30 UTC - Details)

The Fourth Turning: An...

Best Price: $7.92

Buy New $12.04

(as of 08:30 UTC - Details)

“To honor these obligations we could (a) raise all federal taxes, immediately and permanently, by 57%, (b) cut all federal spending, apart from interest on the debt, by 37%, immediately and permanently, or (c) do some combination of (a) and (b).”

The level of taxation and/or Federal Reserve created inflation necessary to honor these politician promises is too large to be considered feasible. Therefore, these promises, made to get corrupt political hacks elected to public office, will be defaulted upon.

- The level of local and state pension and healthcare unfunded liabilities to government workers exceeds $4 trillion. State and local politicians would have to double real estate, sales, and income taxes in order to fund the gold plated benefits for state and local workers. As government workers in Stockton, San Bernardino, Jefferson County and Detroit have experienced, these promises will be not be honored.

- Consumer credit outstanding, despite the false media storyline of austerity, currently stands at $3.3 trillion, an all-time high, as the Federal government took monopoly control of the student loan market in 2009 and proceeded to issue $600 billion of subprime loans to University of Phoenix wannabe graduates seeking degrees in Gender Studies. The Feds also used their five year control of Ally Financial (after their taxpayer bailout) to rejuvenate the subprime auto loan market by doling out $35,000 seven year car loans to unemployed SNAP recipients, because everyone deserves to drive a brand new Cadillac Escalade. The $250 billion increase in auto loan debt since 2009 has “created” the auto recovery. Loan delinquencies approaching 2009 levels will surely not cause a problem.

- Despite the false storyline of corporate America being flush with cash. Corporate debt levels are at all-time highs. The brilliant CEOs of S&P 500 companies decided that adding hundreds of billions in debt to their balance sheets to buy back their stock at or near all-time highs was an outstanding idea. It worked so well in 2007. I wonder if tying their million dollar bonuses to earnings per share had anything to do with it.

- Every legitimate valuation method used to assess stock market valuations for the last 100 years confirm the stock market being at least 100% overvalued. There could not be a worse time for margin debt to also reach all-time highs. The previous peaks in 2000 and 2007 preceded 50% collapses in stocks. The Yellen Put will surely save the excessive risk takers this time. Right?

Civic Decay

- The feelings of anger, disillusionment, confusion, angst, bitterness, blame, and helplessness among a large swath of America is rising by the day. They were so pissed off in November, they voted the D team out of office and put the R team back in control. But more people have begun to realize there is one corporate fascist party in control doing the bidding of Wall Street, corporate CEOs, special interests, and shadowy billionaires who call the shots, select the candidates, write the laws, fund the wars of choice around the globe, and keep the citizens under constant surveillance and threat of military rule by police thugs in communities across the land.

- Despite the false storyline of economic recovery, soaring GDP, plunging unemployment rates, record corporate profits, and stock market highs, the lives of real people living in the real world continue to deteriorate at a rapid clip. The number of people on food stamps in 2009, at the height of the worst recession since the 1930s, was 33 million. Today, five years into the “economic recovery”, the number of people on food stamps is 47 million. This means 19% of all the households in the U.S. depend on the government for food. That figure was 6% in 2000. Does that sound like progress or decay?

- The Federal government insists the unemployment rate has fallen from 10% in 2009 to a miniscule 5.7% today. The ridiculousness of this claim is borne out by the fact the working age population has grown by 14 million since 2009, while the number of employed has only grown by 7 million. The number of people who have left the workforce since the economic recovery started is an astonishing 12 million. In the previous five years, only 4 million people left the workforce. There are now 102 million working age Americans not working versus the 147 million working. The labor participation rate stands at a 38 year low, back to levels before women entered the workforce in great numbers.

- If Obama is boasting about the best job growth in decades, why are real median household incomes below 1989 levels? The non-existent inflation, which has reduced the purchasing power of the USD by 96% since the Federal Reserve was mandated in 1913 to keep our currency stable, has somehow outgrown any wage increases received by the average America for the last 25 years. As good paying full-time jobs have been replace by low paying part-time service jobs, wages have stagnated.